📬 EWVC September Newsletter: Transforming Women's Healthcare one funding round at a time

Welcome to our September edition, where we explore the world of FemTech—tracing its origins, highlighting its growth, and uncovering the trends shaping the future.

Quote of the day: “The word ‘female,’ when inserted in front of something, is always with a note of surprise. Female COO, female pilot, female surgeon — as if the gender implies surprise … One day, there won’t be female leaders. There will just be leaders.”

Sheryl Sandberg is the founder of Leanin.org and the COO of META.

Dear Friends of European Women in VC,

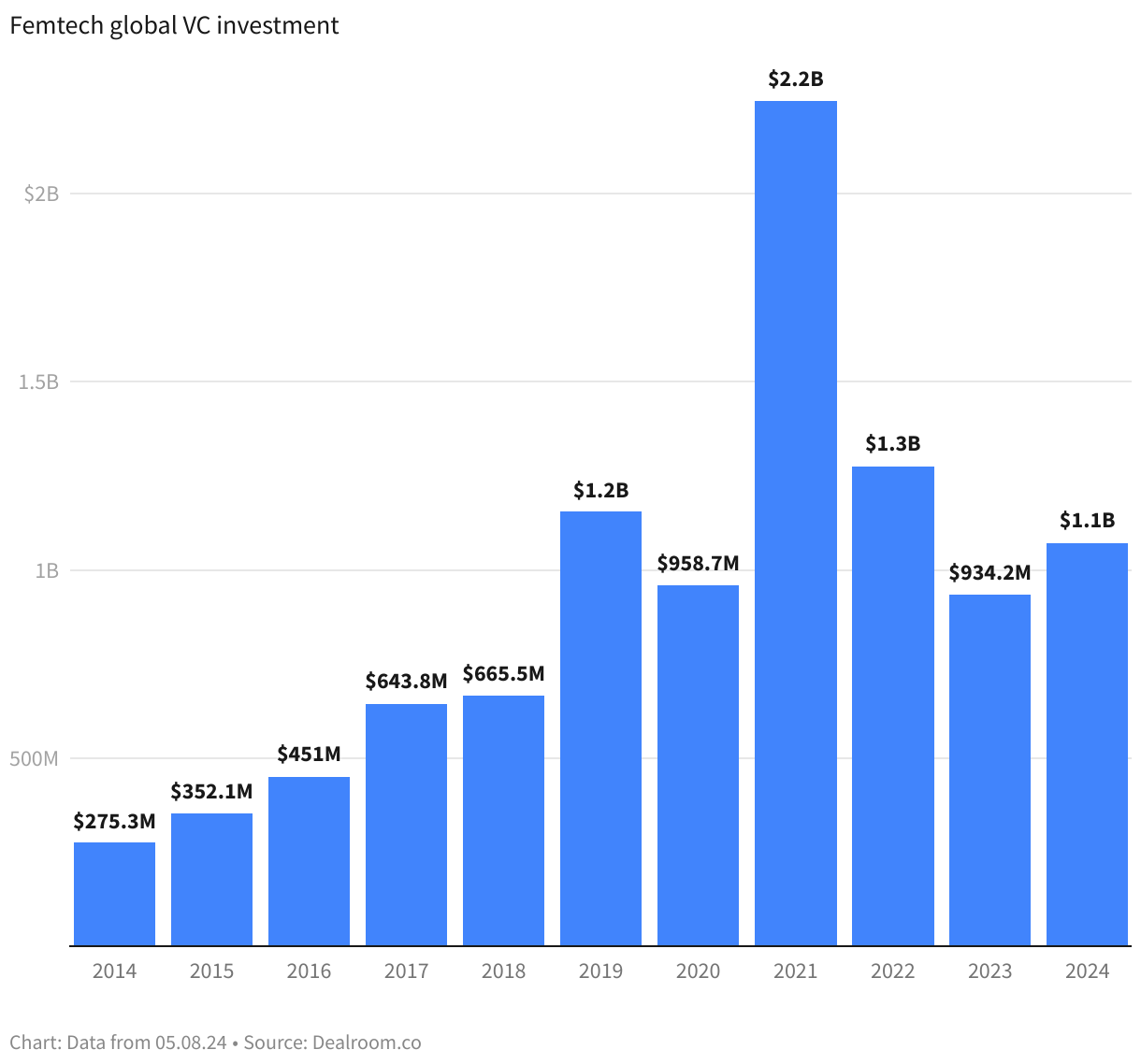

For years, women’s health has been underrepresented in healthcare and tech. But with the rise of FemTech, we’re finally seeing innovation address these long-standing disparities. Today we will explore how FemTech is revolutionizing healthcare for women and why venture capital (VC) investment is key to making healthcare more equitable. Let's get into it!

📚 What is FemTech?

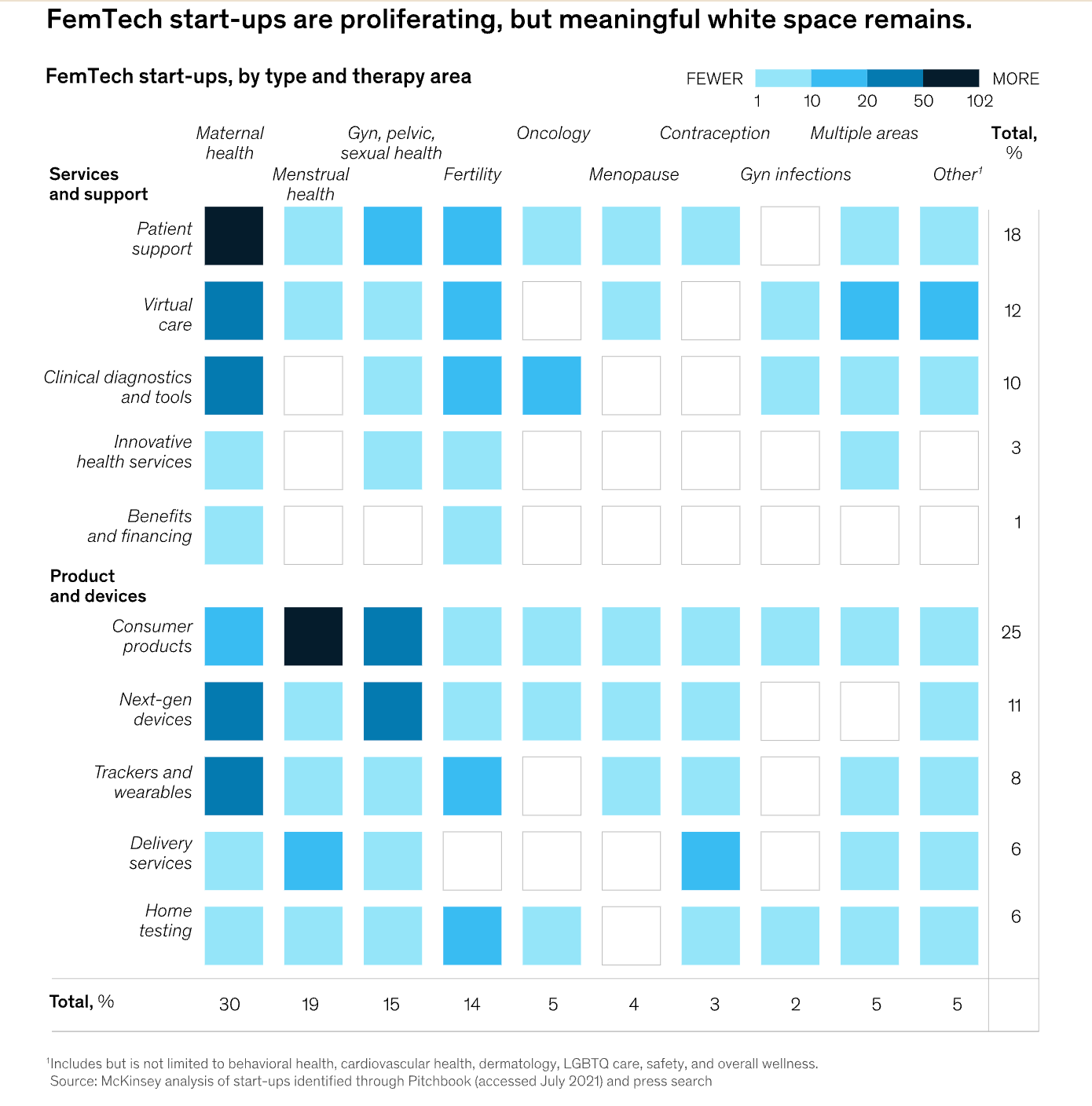

In 2016, Ida Tin, co-founder of Clue, coined the term “FemTech” to describe tech solutions that address women-specific health issues. Since then, the sector has expanded rapidly, tackling everything from reproductive health and fertility to chronic diseases like endometriosis and menopause.

At its core, FemTech is about harnessing the power of technology to improve women's health in ways that were previously overlooked.

💸 Bridging the Healthcare Gap with Every Investment

Despite the sector’s growth, many needs remain unmet, leaving room for new opportunities. Since 2021, FemTech has attracted over $2 billion in VC funding, yet the gender gap in leadership and investment continues to persist. 📉

Here’s the challenge:

Only 21% of FemTech companies have a female co-founder.

Since 2014, only 10% of VC funding has gone to women-(co)founded companies.

Female-led startups raise about $4.6 million, compared to $9.2 million for male-led teams.

This funding gap holds back breakthrough solutions in women's health. It’s time for investors to recognize the immense potential of FemTech!

🤖 Innovation at the Core: AI, Wearables, and More

The future of FemTech lies in AI-powered solutions and wearable technologies. Take apps like Flo with over 230 million users, or startups like Progyny and Maven Clinic, which offer personalized health services for women, right from their phones. 📱

Exciting developments in wearables include companies like Elvie and Astinno, which are creating tech for menopause and reproductive health. By 2030, an estimated 1.2 billion women will experience menopause, and FemTech is paving the way with real-time solutions to address this growing demand.

👩🔬 Key FemTech Players and Categories

Fertility & Menstrual Health: Devices like the Ava Bracelet and apps like Clue lead personalized tracking. (Natural Cycles is FDA-approved as contraception! 💊)

Telemedicine: Platforms like Maven Clinic offer fertility to menopausal care through mobile apps.

Wearables: Devices monitoring hormone levels provide real-time data for better health management.

AI Diagnostics: AI tools are helping diagnose endometriosis and PCOS, often missed or misdiagnosed.

Sexual Health: Innovations like Elvie’s smart pelvic trainer are breaking taboos around women’s wellness. ✨

📢 Regulatory Winds Are Blowing in Favor of FemTech

Governments are finally catching up! Initiatives like the UK’s Women’s Health Strategy and Spain’s paid menstrual leave are changing the landscape for women’s healthcare. These policies are starting to address long-neglected issues, but more inclusivity is needed to meet diverse women’s health needs.

🌍 Global FemTech Market Dynamics

FemTech’s global market is valued at $500 million to $1 billion and is expected to grow at a CAGR of 12.4% through 2032, reaching $87.9 billion.

North America leads the way, with the U.S. holding 50% of global FemTech companies.

Europe is the second-largest FemTech hub, expected to reach $35 billion by 2032, with over 540 companies across 23 countries. 🇩🇪 Germany currently leads the FemTech market with the highest market share in 2023.

Asia-Pacific and MENA regions are experiencing rapid growth, with trailblazers like Nabta Health in the UAE providing digital healthcare tailored for women.

📅 2024: Key FemTech Moments to Watch

January: Flo hits 250 million users, further solidifying its place as a leader in digital reproductive health.

February: Elvie launches a pelvic floor strength monitor, shaking up the pelvic health market!

April: Midi Health raises $60 million in Series B funding, enhancing access to care for perimenopause and menopause.

June: Freya Biosciences secures $38 million in Series A to advance reproductive immunotherapy.

September: Nabta Health expands telehealth services in the MENA region, addressing preventive care needs in underserved areas.

🚀 FemTech Startups to Watch: 2024's Stars

Maven Clinic – Leading in comprehensive women’s health, from fertility to menopause.

Flo Health – With 230M+ users, Flo uses AI to track menstrual and fertility cycles.

Elvie – Innovating wearable breast pumps and pelvic floor trainers.

Kindbody – A network of clinics providing fertility treatments and reproductive healthcare.

Natural Cycles – The first FDA-approved birth control app that uses body temperature to track fertility.

💼 The FemTech Investment Case: Shaping the Future of Women’s Health

FemTech isn't just a passing trend—it’s a transformative force in healthcare, but funding challenges remain. With only 10% of VC money going to women (co)-founded companies, we must champion female founders and promote inclusive, accessible health solutions.

The future of FemTech depends on collective efforts from investors, stakeholders, and advocates to close the funding gap and expand its global impact. The time is now to make healthcare equitable, innovative, and inclusive.

🙌🏼 People who inspired us lately

🔥 Milda Mitkute

Milda Mitkute is co-founder of Vinted and has build Europe's largest secondhand fashion marketplace valued at €3.5B. Milda has now announced that for the past 6 months she has been working on a new EdTech startup.

🔥 Karl Lokko

Karl Lokko is a former gang leader turned VC investor, Founder & Managing Partner at Black Seed. He witnessed his first shooting at 12. By 16, he led his own gang, surviving multiple violent encounters and losing friends to crime. Today, he is dedicated to helping others escape similar paths, advocating for a better and more inclusive ecosystem in the investment space.

🔥 Doerte Hirschberg

Doerte Hirschberg is the General Partner at Climentum Capital, leading investments in decarbonization champions through a climate tech-focused venture fund.

🔥 Raida Daouk El Jisr

Raida Daouk El Jisr is the Founder and Managing Partner of Amkan Ventures, a $10M fund of funds, and founder of Amkan Advisory, a boutique consultancy offering VC-as-a-service.

🔥 Joanna Griffiths

Joanna Griffiths is the Founder and President at Knix, and raised $53M in 2021 just days before giving birth to twins.

🤑 Latest Fund News

Headline raises $865M growth fund to invest in defence and pharma

🇺🇸🇩🇪 US- and Berlin-based Headline has raised $865M for their fourth growth fund, with plans to invest half in Europe. Led by new 🇬🇧 London-based General Partner Shalini Rao, the fund will focus on areas like pharma, software, and defence tech, writing cheques between $20M and $70M.

AENU closes €170M new fund with a new focus and strategy

🇩🇪 Berlin-based AENU has closed its climate tech fund at €170M, moving away from its initial evergreen structure. Led by brothers Fabian and Ferry Heilemann, the fund focuses on seed-stage investments in energy technology and the carbon economy, writing cheques from €1-4M primarily in 🇩🇪 German-speaking countries, the 🇬🇧 UK, 🇩🇰 Denmark, and 🇸🇪 Sweden.

Arāya Ventures raised €9.8M for its Super Angel Fund

🇬🇧 London-based Arāya Ventures, founded by Rupa Popat, has raised €9.8M in the first close of its Super Angel Fund, targeting a total of €22.5M. The fund will focus on pre-seed and seed-stage investments across health tech, fintech, climate, commerce, and future of work, writing cheques from €180K to €490K for up to 60 startups over the next four years.

Wischoff Ventures Secures $50M for Fund III

🇺🇸 Nashville-based Nichole Wischoff has raised $50M for her third fund at Wischoff Ventures, more than doubling the size of her previous funds. The fund will focus on sectors like fintech, logistics, and manufacturing, with plans to write checks between $800,000 and $1.6M for startups.

This is what we’ve been up to 🤸🏽♀️

Baltic VCA Summit, 🇱🇹 Vilnius

During the Baltic VCA Summit, Kinga joined the panel to discuss the positive impact of Venture and Growth Investing, focusing on SDG alignment, climate, diversity and gender in VC and startups with Dovile Burgiene, as a moderator and Anzelika Dobrovolska & Alexander Branton as a co-panelists.

We also organized "Investing in Positive Outcomes" VC/PE and LP breakfast. Thank you to everyone who joined us for this event!

Tesi Portfolio Day, 🇫🇮 Helsinki

The 2024 edition of Tesi Portfolio Day was themed "Dare to grow," it brought together over 200 industry leaders, including LPs, GPs, angel investors, and other professionals from the Finnish VC and PE ecosystem.

Among others, we discussed effective strategies for attracting LP commitments, climate tech's future & AI's global impact.

TechBBQ, 🇩🇰 Copenhagen

At this year’s edition, we discussed the latest findings from our 2024 “Beyond Returns” report during LP Forum in a panel discussion with Johan Attby, Ben Kortlang & Laurits Bach Soerensen, moderated by August Solliv.

We partnered with The Link to support CVC Day, and we hosted an LP-GP Breakfast together with the Export and Investment Fund of Denmark, Mazanti-Andersen, PSV Deeptech Fund, and Crowberry Capital.

We also celebrated Angella Invest's 2nd birthday and together with Thousand Faces & TechBBQ, we hosted a Network & Grow event.

Founders Forum VC Summit, 🇬🇧 London

This event organized by Founders Forum brought together top venture capitalists, industry leaders, and innovators for a day of insightful discussions and networking, focused on the future of European VC.

The drop, 🇬🇧 London

Kasia attended The Drop, the flagship event on climate change, a climate tech festival, for scientists, investors, startups & doers.

Gender Gap in Investments, 🇧🇪 Brussels

Kinga participated in the gender gap discussions of European Innovation Council and SMEs Executive Agency (EISMEA) and the European Parliament.

Climate LP Breakfast, 🇩🇪 Berlin

We co-hosted Full Access LP - 𝗖𝗹𝗶𝗺𝗮𝘁𝗲 𝗟𝗣 𝗕𝗿𝗲𝗮𝗸𝗳𝗮𝘀𝘁 together with the amazing Carbon Equity and bunch.

We had close to 30 LPs join us for a thoughtful panel session on how to best allocate your capital in ClimateTech.

Panelists were Ariyan Seyed Nassir, Founder of Full Access LP, Jacqueline van den Ende, CEO of Carbon Equity, and Selma Meryem Peters, from the European Women in VC core team.

Italian Tech Week, 🇮🇹 Turin

Our team member Alice Tealdi attended Italian Tech Week, a conference that brings together founders, investors, and industry leaders.

To kick things off, our partner MiVC, along with Join Capital and BabyVC, hosted a drinks reception, inviting everyone in the VC community to get ready for the conference ahead!

Throughout the event, Alice engaged with the 🇮🇹 Italian VC ecosystem, attending insightful talks - featuring Alessandra Mazzilli from Earlybird and Jeanette zu Fürstenberg from General Catalyst. A Shot-out to Liftt for hosting an amazing deeptech reception and to b heroes for their drink & deal event, both of which provided valuable networking opportunities and discussions.

Online events 🖥️

"Lunch & Learn" on "BEYOND RETURNS" Report 2024

As part of our Lunch & Learn series, we hosted a discussion for 100 impact aligned investors and managers, where we were joined by Carolyn Dawson, Founders Forum Group | Kevin Rodrigues, bp ventures | Emma Wheeler, UBS, in a discussion moderated by Kinga Stanislawska.

We discussed the synergy between women and positive change, exploring strategies for their involvement at all levels of investment and beyond.

What are we reading and listening 🎧 to?

Breaking Barriers: The first female-led VC firm in🇨🇭 Switzerland

Guests: Jacqueline Ruedin Rüsch, Founding General Partner, and Angelica Morrone General Partner from Privilège Ventures.

Learn more about their investment strategies, the benefits of gender-diverse teams, their efforts to support women entering the venture industry and more.

Building a global ecosystem for FemTech pioneers

Guest: Marija Butkovic, Founder and CEO of Women of Wearables (WoW)

Learn Marija's journey from commercial lawyer to FemTech leader, the global ecosystem for female innovators in wearable and health tech, and the untapped potential within the Femtech sector.

Addressing unmet needs and research gaps with the Society for Women’s Health Research

Guest: Kathryn G. Schubert, President and CEO of the Society for Women's Health Research.

Learn more about SWHR's work, the potential for an Institute for Women's Health, and methods of increasing participation of underrepresented populations in clinical trials.

Invest in Women: Let’s Accelerate the Progress

Author: Rani Miller, Partner DACH at KeySearch.

Despite advancements, women remain underrepresented in tech roles, leadership, and STEM fields, and the gender pay gap continues to be an issue. Biological, political, and cultural factors, alongside caregiving responsibilities, often hinder women’s career progression.

Top 50 women from VC and startup ecosystem in Switzerland

Author: Aleksandra Wirth, Marketing Manager – Vestbee.

Despite progress, recent data shows a significant gender gap in the🇨🇭Swiss ecosystem, with only 12.8% of venture capital going to female founders in 2023. Vestbee has curated a list of standout Swiss startup founders, co-founders, CEOs, CTOs, and active players in venture.

Lessons from Investing in 81 Venture Capital Funds

Guest: Dave Neumann, Investor at Molten Ventures.

The podcast episode explores insights into FoF deployment strategies, how GPs should approach fund size and interesting power law data derived from Molten’s 2,500 underlying portfolio companies.

Being Non-Consensus and Right in VC

Guests: Jason Shuman, General Partner at Primary Venture Partners & Will Quist. Partner at Slow Ventures.

In the latest episode of the Origins podcast, Notation Capital’s Nicholas Chirls and Sapphire Partners’ Elizabeth "Beezer" Clarkson host two GPs Jason Shuman and Will Quist, who shared how their respective firms approach building teams and platforms.

You might also like 📚👀

Energy transition at risk: The imperative to innovate in mining

Author: Nucleus Capital.

The transition to renewable energy requires a significant increase in critical minerals, which are essential for technologies like batteries, solar panels, and wind turbines. However, mining challenges, such as lower-quality ores and environmental concerns, complicate the situation.

Transforming impact funds: 3 reasons to link compensation with impact

Author: Christin ter Braak-Forstinger, CEO and co-founder of Chi Impact Capital.

As impact investing becomes more mainstream, impact-linked compensation can distinguish genuine efforts from marketing tactics, ensuring fund managers stay committed to their objectives. This model is predicted to become an industry standard, promoting transparency, trust, and long-term success in the impact investment sector.

The state of VC market in 2024

Guest: Tzlil Kovetz, Principal at Vintage Investment Partners.

Learn about Vintage's perspective on the European venture market, trends in tech investments, and insights on the state of the VC market in 2024.

European versus Silicon Valley on the Investment and Funding Landscape

Author: Elsa Hyland, Angel investor.

Silicon Valley, with its deep history in tech innovation, offers larger funding opportunities. In contrast, Europe's startup scene, which emerged later, has matured with a focus on sustainability, fintech, and impact investing, but still lags in commercialization and risk tolerance.

Investing for impact in braintech, interview with Anne-Sophie Saint-Martin from Newfund

Author: August Soliv, Author of Impact Supporters

Braintech is vital as populations age and chronic neurological diseases rise, yet it's lagging behind other areas like cancer in diagnosis and treatment. August & Anne-Sophie discuss how 🇪🇺 Europe matches the 🇺🇸 USA in braintech innovation, but commercialization is stronger in the US due to higher prices and FDA approval challenges.

Open Source or Not: How to Pitch Your Open-Source Community

Author: tunyabytes 1.1

Tunya Irkad, VC at 500 Emerging Europe launched the first episode of tunyabytes with a discussion on open-source software, commercialization, and when is the right moment to do it.

In other news 📺

Bpifrance announces the exit of Sonio

Sonio, a MedTech company specializing in women's and children's health, announced its acquisition by Samsung Medison, following approval from the 🇫🇷French Ministry of Economy and Finance. Founded in 2020, Sonio has developed AI-powered solutions for prenatal ultrasound scans, improving diagnostics and care. This acquisition aims to further expand Sonio's global reach and enhance maternal care technology, particularly in regions with caregiver shortages.

Dr Guenther Dobrauz-Saldapenna joins Chi Impact Capital

Chi Impact Capital, a firm dedicated to sustainable and impactful investments, proudly announces that Dr. Guenther Dobrauz-Saldapenna has joined as a Partner. His appointment comes at a pivotal time as the firm prepares to launch its upcoming Circularity Fund, which will focus on advancing sustainable solutions globally.

Palatine and Volution Office Hours Event

Volution is inviting fintech and SaaS founders, particularly those in the seed and Series A stages in 🏴 Manchester, to join their Office Hours event on Wednesday, October 9th. Hosted in collaboration with Palatine Growth Credit, this event offers the opportunity for founders to receive guidance on topics like fundraising, go-to-market strategies, partnerships, team building, and more.

2150 brings together climate leaders en route to The Drop

2150 proudly convened co-investors, Limited Partners, and climate innovators on a unique journey to The Drop, a leading climate conference. Co-hosted and co-sponsored by HSBC Innovation Banking and Mazanti-Andersen.

Apply to Europas 100

Europas 100 is an awards event celebrating Europe's most innovative and ambitious tech startups, including those from the MENA region. The event closes with a celebration in 🇵🇹Lisbon on November 11, 2024, where the top 100 startups will be honored. Applications are due by October 1, 2024, and there is a £125+VAT fee. Winners will be announced on November 11, 2024.

Hello Tomorrow Deep Tech Days

The next edition of Hello Tomorrow Deep Tech Days is happening on March 10-14, 2025, in 🇫🇷 Paris, with a three days filled with pitches, meetings, panels, workshops, VIP events, and more. As members of our community, you're the first to know about our early bird 15% discount!

Meet our team 🧳 at:

SLUSH, November 19-21th, 🇫🇮 Helsinki

LP/GP Breakfast at SLUSH, November 20th, 🇫🇮 Helsinki

Attend one of our partners’ events 🎟️:

How to Web, October 2-3rd, 🇷🇴 Bucharest.

We have a few free tickets available, please contact us at info@europeanwomenvc.org to get one.

Sifted Summit, October 2-3rd, 🇬🇧 London

Valencia Digital Summit (VDS), October 23-24th, 🇪🇸 Valencia.

We have a few free tickets available, please contact us at info@europeanwomenvc.org to get one.

0100 Conference Mediterranean 2024, October 28-30th, 🇮🇹 Milan.

20% discount on tickets. Use code: EWVC20

Fe:male Invest Summit 2024, November 6, 🇸🇪 Malmö.

10% discount on tickets. Use code: NFISxEUVC24

With Intelligence - Women's Venture Capital Summit, December 2nd-4th, 🇬🇧 Hertfordshire.

20% discount on tickets. Use code: EWVC20.

We're a squad of over 1000 senior female venture capital wizards from all over Europe and beyond. We're here to flip the script and make things right.

Join us in shaking up the VC world! 🚀

See you soon,

European Women in VC

Follow us on LinkedIn