📬 EWVC October Newsletter: Reigniting Europe's Competitiveness

As autumn unfolds, Europe faces a pivotal moment in determining its future role in the global economy. Today, we explore Mario Draghi’s comprehensive analysis of Europe's competitiveness.

Quote of the day: "Productivity growth is the only possible way to achieve prosperity."

Mario Draghi - Economist, statesman, reformer.

We deliver in-depth research, but your inbox may limit our message. To read the full newsletter, please access it through the Substack app here.

Dear Friends of European Women in VC,

This month’s newsletter highlights crucial insights from Mario Draghi's latest report on the future of European competitiveness, emphasizing the urgent need to adapt to a rapidly changing global landscape. Below, we explore five areas of focus for Europe to reclaim its competitive edge.

The Current State of European Competitiveness

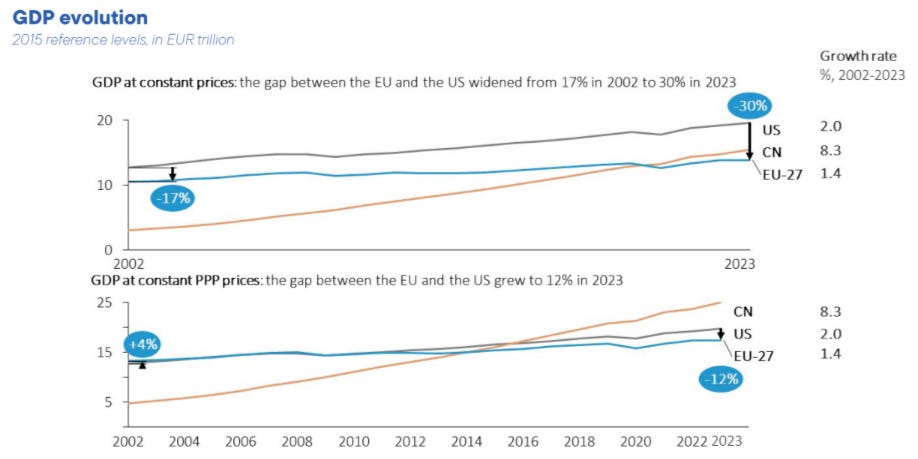

Europe is at a crossroads, grappling with interconnected challenges that threaten its global standing. Productivity growth has slowed considerably, exacerbating a widening GDP gap with the US. Since 2000, real disposable income in the US has grown nearly twice as much as in Europe (Draghi Report, European Commission, A Competitive Analysis, page 8).

Key Data Points:

The EU accounts for 17% of global GDP but faces productivity disparities compared to the US and China.

Energy prices in the EU are 2-3 times higher than in the US & Natural gas prices are 4-5 times higher in Europe than in the US.

1. Closing the Innovation Gap: A Call to Action

Europe's innovation deficit is a major drag on its productivity. The gap in research and development (R&D) investment compared to the US is vast, with the EU spending €270 billion less in 2021. This underinvestment is particularly problematic in advanced technologies like AI and quantum computing (Draghi Report, European Commission, A Competitive Analysis, page 2). Key challenges are driven by regulatory barriers and a lack of high-growth European companies.

Key takeaways:

The innovation capacity of the EU as a whole continues to lag behind that of the US.

The EU produces almost one-fifth of the world’s scientific publications.

By 2040, the EU's workforce is projected to shrink by close 2 mln workers each year.

70% of foundational AI models and over 65% of global cloud market share are held by US firms, while the largest European operator accounts for only 2%.

Integrating AI ‘vertically’ into European industry will be a critical factor in unlocking higher productivity.

The EU has a unique opportunity to lower the cost of AI deployment by increasing computational capacity and making available its network of high-performance computers.

Europe is strong in autonomous robotics (22% of global activity) and AI services (17%); however, innovative companies struggle to scale and attract later-stage financing, with no EU company surpassing a market cap of €100 billion in the past 50 years.

Fragmentation of the Single Market hinders innovative companies that reach the growth stage from scaling up in the EU, which in turn reduces demand for financing. The share of global VC funds raised in the EU is just 5%, compared to 52% in the US and 40% in China.

Europe needs to make it easier for “inventors to become investors” and facilitate scaling up of successful ventures.

2. Energy: Navigating the Path to Decarbonization

While the EU is a global leader in renewable technologies like wind and hydrogen, it faces significant challenges due to high energy costs and dependence on imports.

Key Takeaway: The combination of a high share of energy imports and high prices results in a major drag on resources in the EU compared to other regions globally.

EU develops over 20% of global clean technologies.

Barriers like inconsistent regulation and lack of financing hinder growth, limiting EU companies' ability to scale and widening the funding gap with the US.

The primary energy sector goal is to lower end-user costs by sharing decarbonization benefits. While EU gas demand may drop 8%-25% by 2030, EU faces volatility as 42% of imports were LNG in 2023, up from 20% in 2021.

The second objective is to speed up decarbonization cost-effectively with a technology-neutral approach, covering renewables, nuclear, hydrogen, bioenergy, and carbon capture.

Europe must balance decarbonization with industry competitiveness. For instance Chinese EV subsidies could cut EU production by 70%, threatening millions of jobs and clean tech gains. The “European Green Deal” seeks green jobs, but de-industrialization risks its success.

Transport is key to EU decarbonization, but requires better planning and supportive regulation.

3. Security and Supply Chain Resilience: Reducing Dependencies

Europe’s reliance on imports, particularly from China, for critical raw materials and semiconductors, leaves key industries vulnerable.

Key Data Points:

Europe imports 75-90% of its semiconductors, critical for industries like electronics and automotive.

Critical raw materials: Over 80% of Europe's digital infrastructure relies on imports.

About 40% of Europe’s imports are sourced from a small number of suppliers and difficult to substitute, with half from strategically non-aligned countries, making Europe vulnerable to trade disruptions.

CRMs (critical raw materials) supply is highly concentrated, with China controlling 35-70% of processing which cause price volatility. Demand has surged—tripling for lithium and rising 70% for cobalt since 2017—and is expected to grow 4–6 times by 2040.

In 2022, Europe allocated a total funding of EUR 10.7 billion for defence R&D, amounting to just 4.5% of total spending.

Geopolitical tensions require Europe to boost defense spending, especially as U.S. focus shifts to the Pacific. Only 10 EU countries meet NATO’s 2% GDP defense target. If all did by 2024, spending would increase by €60 billion. Given depleted stocks and decades of underinvestment, the EU estimates €500 billion in defense investments is needed over the next decade.

4. Financing Growth: A Massive Investment Push

The report estimates that Europe will need an additional €750-800 billion annually to bridge the funding gap. EU spending on R&D lags far behind the US. Significant public and private sector support will be essential to meet future growth targets.

Key Takeaways:

The EU can meet its investment needs without straining the economy. Simulations suggest that sustained investments of 5% of GDP could boost output by 6% within 15 years, although this may cause temporary inflation.

The EU heavily depends on bank financing, which often fails to support innovative projects. Despite the increased role of capital markets post-GFC, bank loans remain the primary source of external funding. However, banks struggle to evaluate innovative firms and lack expertise in valuing intangible collateral.

EU banks face lower profitability than US banks. Regulatory constraints further hinder their ability to use securitization, which was only 0.3% of GDP in the EU in 2022, compared to 4% in the US.

The EU’s annual budget amounts to just over 1% of EU GDP, while Member States’ budgets are collectively close to 50%. It is also not allocated towards the EU’s strategic priorities.

To unlock private capital, the EU must build a genuine Capital Markets Union (CMU) supported by a stronger, engaged pension sector.

By building on the NGEU model, the EU can finance initiatives that enhance competitiveness and security.

5. Governance and Policy Coordination: A Unified Approach

For Europe to effectively navigate these challenges, it must streamline its governance structure. Policy fragmentation and regulatory burdens, particularly for SMEs, are hindering the region's growth potential.

Key Takeaways:

EU resources should focus on funding public goods that are critical to the EU’s strategic priorities.

Council votes subject to qualified majority voting (QMV) should be extended to more areas.

The regulatory burden on EU companies is high and continues to grow, but the EU lacks a common methodology to assess it.

EU companies face three key regulatory challenges. First, Frequent changes to EU legislation create overlap and inconsistencies. Second, extra burden due to national transpositions. EU regulation imposes a proportionally higher burden on SMEs and small mid-caps than on larger companies, yet there is no framework to assess these costs.

Conclusion: A Collaborative Future

Europe's future competitiveness hinges on swift, coordinated action across innovation, decarbonization, and security. For women in venture capital, this represents an exciting opportunity to drive change & support innovation.

At European Women in VC we support "EU-Inc", an initiative aimed at uniting the startup ecosystem across Europe. You can join us by signing the petition below.

🙌🏼 People who inspired us lately

🔥 Charlotte Palmer

Vice-President at Integra Global Advisors, Venture Capital Advocate

Charlotte Palmer oversees a fund with €700M AUM, focusing on early-stage and emerging managers across the US, Latin America, Europe, and Israel. In a recent EUVC podcast episode, she discussed the evolving role of government LPs in Europe.

👉 Check out the full interview here.

🔥 Kristina Shen

Co-Founder of Chemistry | Early-Stage Venture Investor

Kristina Shen is a co-founder of Chemistry, a newly launched $350M early-stage venture fund focused on making high-conviction investments in Seed and Series A stages. Alongside her partners Ethan Kurzweil and Mark Goldberg, she draws on their shared experiences and networks to offer unique support to founders.👉 Check out the full interview here.

🤑 Latest Fund News

Adara Ventures Raises Series A for Climate-Tech & Energy Transition

The European Investment Fund (EIF) has invested €35M in Adara Ventures' latest Energy Transition Technologies Fund. This new fund will support early-stage European tech companies focused on clean energy innovation, with an emphasis on energy efficiency, sustainable energy production, and carbon reduction solutions.

👉 Read the full story here.

PSV Hafnium is Live!

🇩🇰 Denmark celebrates the launch of its first early-stage deep tech venture fund, PSV Hafnium, achieving a remarkable first close of DKK 385 million this summer. Led by a diverse partner team—Marianne Hyltoft, Anders Kjær, Jakob Rybak-Andersen, and Maria Emilie Danø Hoffmann—the fund exemplifies the power of diversity in driving innovation. 🚀

👉 Read the full story here.

20VC Closes $400M Fund for European Investment

Harry Stebbings, creator of the popular tech podcast 20VC, has expanded his footprint in venture capital by closing a new $400 million fund under the same name. Known for interviewing top venture capitalists and founders, Stebbings has leveraged his media influence to establish 20VC as a well-recognized name in tech investing. The fund will concentrate on supporting European startups, addressing what Stebbings sees as Europe's under-appreciated potential. We congratulate Harry on this amazing achievement and would be thrilled to see women raise such amounts and at such speed! 🤞🏻

👉 Read the full story here.

Index Ventures Raises $2.3B in New Fund, Hannah Seal Explains

Hannah Seal, Partner at Index Ventures, shares insights on their new funds, founder relationships, scaling, and the European venture landscape. As a leader at Index, she focuses on transforming traditional sectors through B2B software and enterprise AI. Her investments include DataSnipper, Remote, Multiverse, and Fonoa, all companies reshaping large industries through technology.

👉 Read the full story here.

In other funding news 📺⚡

Repath Raises Successful Seed Round!

Nordic Climate Tech

🇩🇪 The Hamburg-based climate tech company Repath has successfully raised €3.6M in a seed funding round! 🔥A big shoutout to our members Greencode Ventures, Auxxo Female Catalyst Fund, and Nucleus Capital for their collaborative investment! Additional supporters include Lightbird, WENVEST Capital, Better Ventures, and Triple Impact Ventures.

👉 Discover their plans here

Synergi’s €2M Seed Funding

GreenCode Ventures Leads the Way

Synergi has closed a €2M seed funding round, led by GreenCode Ventures with participation from Vaens, Lifeline Ventures, HEARTFELT_, and Wave Ventures. Synergi is working to transform energy management for households by optimizing energy use for sustainability 🌍⚡.

👉 Check out the full details here

CarbonFuture’s Series A

Pioneering Carbon Capture Technology

CarbonFuture, a leader in carbon capture and removal, has secured significant Series A funding led by SIX to expand its innovative carbon sequestration platform. This investment marks a major step forward in the fight against climate change.

👉 Discover their plans here

Zepz, formerly WorldRemit, raises $267 million to expand in Africa

Money Transfer Fintech

Formerly known as WorldRemit, Zepz has raised $267 million in funding from new and existing investors to fuel its expansion in its core African markets and beyond. Accel led the round with participation from Leapfrog, TCV, and Coller Capital.

👉 Discover their plans here

🎧📚 What are we reading and listening to?

Climate Guide, by Revaia

🌱 Revaia’s Climate Guide

Revaia’s guide on climate investing is essential for anyone looking to align portfolios with impactful initiatives.

👉 Read it here

Tilia’s Impact, by Tilia Capital

🌍 Tilia’s First Impact Report

Marking one year since the launch of Tilia Fund II, Tilia Impact Ventures has released its first public Impact Report—a comprehensive look at their journey to support People and Planet with measurable, transparent impact.👉 Download the report here.

The 2024 Funding Napkin, by Nucleus Capital

🌱 Made with Biology: 2024 Funding Napkin

Nucleus Capital’s blueprint for bio-engineered solutions and sustainable investments.

👉 Check it out here

The Series A Blueprint, by XAnge

XAnge’s guide for Europe’s ambitious Seed founders on the road to Series A! This 200-page book provides actionable insights, proven strategies, and real-world examples to help founders navigate the critical leap to Series A.

Fund Returners Index Report, by Kauffman Foundations

📊 Kauffman Foundation’s Fund Returners

The report highlights significant trends for VC returners—those who have successfully raised subsequent funds after their first—and reveals that repeat funds often outperform initial funds, largely due to refined strategies and better network effects.

👉 You can access the full report here.

Ecosystem Guide, by Dealroom

Dealroom’s 2023 Global Startup Ecosystem Guide presents a comprehensive analysis of the current trends, strengths, and shifts within the global startup landscape. The guide highlights notable insights, such as the rapid growth of emerging tech hubs outside traditional ecosystems, including LATAM and Southeast Asia, as well as the increased emphasis on climate tech, which is now one of the fastest-growing sectors globally.

👉 For more insights, explore the full guide on Dealroom's website.

How Elite Endowments Invest in 2024

In this episode of the 10X Capital Podcast, Renee Hanna, Managing Director of Investments at Baylor University, discusses the university's investment strategy with host David Weisburd. They explore how Baylor allocates funds between public and private investments, emphasizing the importance of return hurdles for private investments.

👉 Listen to the full episode here.

📚👀 You might also like

Philanthropy Driving Innovation

Melinda Gates' Pivotal Ventures is redefining venture capital by focusing on women and underrepresented groups. This approach targets systemic changes in women's health, economic empowerment, and education, aiming for scalable solutions to address inequalities.

👉 More on their mission here

Female Founders in Ukraine’s VC Ecosystem 💼

Despite significant challenges, female founders in 🇺🇦 Ukraine are innovating and contributing to economic resilience. They leverage tech to foster growth and are shaping the future of Ukraine’s tech and VC landscape.

👉 Read about their impact here

The state of art and evolution of AI

Sequoia Capital’s recent analysis of generative AI explores its revolutionary impact on workflows and market potential. It highlights how foundational models are evolving from research phases into valuable enterprise tools. Key use cases are emerging, like streamlined content creation, enhanced customer interactions, and operational efficiencies, as organizations increasingly adopt these tools to drive productivity and unlock new business models.

👉 For a deeper dive, read the full article on Sequoia’s site.

AI Transforming Private Equity Landscape 🤖

A recent report highlights that artificial intelligence (AI) is set to impact every facet of private equity. Industry experts emphasize the technology's potential to enhance decision-making, streamline operations, and improve portfolio management. AI-driven tools are becoming essential for evaluating investment opportunities and optimizing performance across various sectors. The integration of AI not only offers efficiency but also raises questions about data security and ethical considerations in investment strategies

👉 For more information, check out the piece of news.

Top Femtech Active Investors

Vestbee highlights the most active European VC funds championing femtech, a sector focused on women's health and well-being. Key players include Portfolia, which exclusively backs female-led ventures; Octopus Ventures, known for investing in tech with positive social impact; and Speedinvest, which is strongly committed to healthcare innovation. Other notable firms like Kindred Ventures and Balderton Capital are also mentioned for their role in nurturing early-stage femtech companies across Europe.

👉 Discover the top FemTech investors here

Empowering Women Entrepreneurs in Birmingham 🚀

🇬🇧 Birmingham has introduced a new accelerator program designed to empower female-led startups, offering investments of up to £2 million. This initiative aims to tackle the gender gap in entrepreneurship by providing customized support, mentorship, and networking opportunities for women entrepreneurs in the area. The accelerator focuses on fostering growth and innovation among female founders, helping them navigate the challenges of starting and scaling their businesses.

👉 Check it out here!

This is what we’ve been up to 🤸🏽♀️

WVC:E Summit, 🇫🇷 Paris

Selma attended the WVC Summit in 🇫🇷 Paris at STATION F, with the focus on female investors. Key points:

1️⃣ How to win a deal in a competitive market – A fantastic session with Jimena Nowack from Dawn Capital, Deepali Nangia from Speedinvest, and Véronique Jacq from Bpifrance. They shared key insights on building trust, timing, and developing expertise in VC.

2️⃣ Roundtable on diversity and returns – thanks to Sophie Winwood for the opportunity to represent European Women in VC and discuss how diverse teams drive better financial returns.

Read the full “Beyond returns” report here.

Missing Middle reception, 🇬🇧 London

Alice attended Missing Middle reception in 🇬🇧 London - the launch of Smart Society Ventures white paper, addressing the gender gap in the late-stage VC.

She joined the panel along with Brynne Kennedy (Managing Partner, Smart Society Ventures), Laura Fritsch (Co-Founder, Residual Carbon), Rana Modarres (Impact Director, M&G plc), Mike Turner (Partner, Latham & Watkins) moderated by Debbie Wosskow, OBE (Co-Chair, Invest in Women Taskforce)

They discussed the current underrepresentation of female representation amongst the VC ecosystem and how to overcome the challenges and improve the status quo, and we are thrilled to partner with such initiatives.

Meet our team 🧳 at:

SLUSH, November 18-21th, 🇫🇮 Helsinki

House of Impact, November 18th - 19th

INNOVEIT -Pioneering women: driving innovation and investment in Europe, November 19th

Roundtable at SLUSH: Profit & purpose–How venture and growth can drive returns, societal change and impact, November 19th

LP/GP Breakfast in 🇫🇮 Helsinki, November 20th, 8:00 - 10:00

With Intelligence - Women's Venture Capital Summit, December 2nd-4th, 🇬🇧 Hertfordshire.

20% discount on tickets. Use code: EWVC20

Attend one of our partners’ events 🎟️

Fe:male Invest Summit, November 6, 🇸🇪 Malmö.

10% discount on tickets. Use code: NFISxEUVC24

Techchill, February 5-7th 2025, 🇱🇹 Riga.

15% discount on tickets. Use code: EUWVCxTechChill

We're a squad of over 1000 senior female venture capital wizards from all over Europe and beyond. We're here to flip the script and make things right.

Join us in shaking up the VC world! 🚀

See you soon,

European Women in VC

Follow us on LinkedIn