📬 EWVC May Newsletter: Investors education and the future of venture capital

Welcome to our latest newsletter edition covering the role of 🎓education in VCs, essential skills in fundraising, decision making, and more.

Quote of the day: “You can teach a student a lesson for a day; but if you can teach him to learn by creating curiosity, he will continue the learning process as long as he lives.” by Clay P. Bedford

Dear Friends of European Women in VC,

This month, we are introducing you to a dear theme in our hearts respectively the role of education for investors and VC. We have just launched Venture.Forward. an online BootCamp for early and mid-career female professionals 🔥

This program is designed to equip rising stars in the industry with the skills and mindset necessary to fast-track professional growth and to step into larger roles in the venture capital sector confidently.

The program is organised by the EIT (European Institute of Technology) Community and their Supernovas programme in collaboration with European Women in VC.

We recognize the importance of education and are committed to fostering a learning environment. This is one of the reasons why we created the Venture.Forward. Academy, and why we want to address the importance of education in this newsletter.

Building a successful career in venture capital requires a unique blend of skills and knowledge. While experience and intuition play a vital role, a strong educational foundation is essential for navigating the complexities of the investment landscape.

This newsletter explores the role of education for investors and VCs. We'll delve into how education empowers you to:

Stay ahead of the curve: The VC industry thrives on innovation. New technologies, business models, and regulatory frameworks emerge constantly. As an investor, you build a habit of staying on top of the latest news and technology trends to identify investment opportunities with high-growth potential.

Expand industry knowledge: Whether you specialize in healthcare, fintech, or cleantech, continuous learning allows you to delve deeper into the ins and outs of your chosen sector. So, you can assess the viability of startups, understand market dynamics, and anticipate potential challenges.

Build a strong relationship network: Events and programs often foster connections with industry experts, potential co-investors, and entrepreneurs.

The need for investor education extends beyond individual VC success. Every European needs to become an investor in their own right! Why? An aging population in Europe places immense strain on traditional pension systems. As citizens take on greater responsibility for their financial well-being, financial literacy is no longer a luxury but a fundamental life skill.

The need for continuous education is also supported by a study by the European Investment Bank, which shows that skills are the center of employability and facilitate finding jobs that allow people to realize their potential. Limited availability of skills now tops the list of corporate concerns, replacing uncertainty as the most frequently named obstacle to investment.

In venture capital, these problems are also impacted by the lack of diversity. European investors are noticing these challenges and addressing the need for more female investment role models.

“If we have role models who have a similar background to our own, we can relate to them and feel more confident because they serve as proof points.

As a consequence, it’s very important to empower young women by sharing your own story, speaking up and offering support to those who may need some external motivation and inspiration at the beginning of their careers.”

Says Carina Harding, an investor at Picus Capital.

As you probably know from our European Women in VC Report from 2023, General Partnership in European venture capital firms is still “a boys club.”

“We need to change the predominant culture in entrepreneurship and start-up ecosystems, which is a sexist and macho culture that excludes projects led by women.”

says Angélique Gerard, one of France’s top business angels

This is why we need more women to join the venture capital space. We need diverse backgrounds and different perspectives. Here is a short and engaging explainer video to help you better understand how to break into the VC world, explained by a former VC.

Investing in your education is an investment in your long-term success. To thrive in this environment, VCs need to embrace lifelong learning fully.

Another thing that needs to be addressed for and by people working in the VC space is skills. Professionals working in this sector come from different sectors, as seen in a study of Crunchbase.

Beyond education, a successful VC career requires a unique blend of skills. Here are three fundamental areas to focus on:

Analytical mind: VCs are constantly assessing potential investments. Strong analytical skills are needed to understand market dynamics and evaluate the viability of a startup's business model. Due diligence involves deep research into the company's team, technology, and competitive landscape to uncover potential risks and opportunities.

Networking & relationship building: to connect with entrepreneurs, co-investors, and industry experts to source deals, share knowledge, and collaborate. Excellent communication skills are essential to building trust, expressing complex information effectively, and negotiating deals with clarity and persuasion.

Broad vision & laser focus eyes: VCs are not just investing in the present but betting on the future. Investors need to be visionary thinkers who can recognize patterns and anticipate disruptive technologies shaping their chosen industries.

Fast decision-making: they often make investment decisions with limited information and high uncertainty. Investors need to think critically, act decisively, and adapt their strategies to protect and grow their portfolios.

Before going to the next topic, we also want to leave some of the best educational resources for learning how to develop your skills as a VC, for both newcomers in the industry, as well as seasoned professionals:

Oxford Entrepreneurship: Venture Finance Programme [Online]

VC Unlocked: Stanford University by 500 Global [Offline]

VC Unlocked: online courses on term sheets, cap tables, and more [Online]

VC University: certificate course [Online]

Newton Programme: learn the fundamentals

We can’t close the discussion and don’t want to do it all! So, please share your thoughts in the comments section below, reply to our newsletter, or start your conversation on social media.

🙌🏼 People who inspired us lately

🔥Yonca Braeckman & Alina Klarner - Impact Shakers.

Yonca Braeckman, co-founder & CEO and Alina Klarner, General Partner at Impact Shakers Ventures have launched a €20M VC fund to back diverse founders.

The new venture fund will invest in European early-stage startups in the climate tech, impact infrastructure and inclusion tech sectors, led by diverse founders who are often overlooked by financial institutions.

Full story on Impact Investor.

“The main aim is to invest in diverse teams.” says Alina Klarner.

🔥Anta Gkelou - Sofinova Partners.

Sofinnova Partners promotes Anta Gkelou as Partner in the fund, alongside Guillaume Baxter. Anta previously worked as an immunology scientist at Danone Nutricia, and joined Sofinnova as an Analyst in 2017.

Full story on Venture Capital Journal.

🔥Shruti Gandhi - Array Ventures.

Shruti Gandhi, General Partner & Founding Engineer at Array Ventures and a solo venture capitalists celebrates a wonderful milestone.

15 exits in 5 years. Full story on Business Insider.

Success stories 🎉

Norrsken closes the second fund oversubscribed at €320M.

Full story here. Well done Agate, Tove, Niklas and entire Team! You continue to inspire!

While we celebrate today, we realize one thing: impact investing might be booming, but the capital available here is still a drop in the ocean - representing roughly 1% of total assets under management worldwide.

We have a long road ahead of us, but we are die-hard optimists, so we believe that every single day, we are closer to our ultimate vision - every dollar invested or a company started is net positive for people and the planet!

said Agate S. Freimane, General Partner at Norrsken VC

EIF closes European Year of Skills with three InvestEU guarantee agreements for 40,000 student

The European Investment Fund, alongside the European Commission, unveiled three new guarantee agreements aimed at financing education for nearly 40,000 students in Germany and Spain.

The guarantees will support over €100 million in new financing to enhance skills over the next three years.

Full story here.

“When we invest in people, we invest in the future of Europe,” said Marjut Falkstedt, Chief Executive of EIF.

GoHub Ventures, Data Point Capital, and Adara Ventures invests in Indigitall.

The funding round was led by Data Point Capital, a venture capital firm based in the United States, along with GoHub Ventures and Adara Ventures, two Spain-based venture capital firms.

Full story here.

“Their exponential growth, the potential of their product, combined with the knowledge and vision of the founders, and their ability to attract foreign capital, are the factors that lead us to bet on Indigitall. says Inés Calabuig, Managing Partner at GoHub Ventures.

Female founded and lead Greencode Ventures boosts green hydrogen

Greencode Ventures recently lead the EUR 1,6 million round of early-stage start-up Southern Lights, a Swedish start-up that is digitizing the green hydrogen space. The company aims to digitize the green hydrogen industry and serve as a strategic partner to energy companies, helping to accelerate hydrogen adoption across various industries.

Full story here.

“We are thrilled to lead Southern Lights´ funding round. Hydrogen has a great potential to electrify heavy industries, which is crucial for the green transition. Southern Lights´ solution is uniquely positioned to accelerate the adoption of hydrogen and become the digital layer across the value chain.” says Ines Bergmann-Nolting, Managing Partner at Greencode Ventures.

Cozero raises €6.5M for climatetech software.

Cozero, a German climate tech company, secured €6.5 million in Series A funding. This investment will fuel Cozero’s international expansion and further develop its Climate ERP platform, designed to integrate sustainability seamlessly with core business operations.

Full story here.

"Climate management tools must evolve, allowing organisations to effectively measure and reduce their carbon footprint by linking climate actions to business impacts. says Helen Tacke, CEO and co-founder of Cozero.

This is what we’ve been up to 🤸🏽♀️

2024 Milken Institute Global Conference in 🇺🇸 Los Angeles

At the 2024 Global Conference by the Milken Institute, Kinga Stanisławska from our team discussed the Future of Europe with co-panelists Dr. Benedetta Berti, Nobel laureate Prof. Mike Spence, and Benedikt Franke, moderated by Suzanne Lynch of POLITICO Europe.

They stressed the importance of collaboration for global peace and highlighted the role of breakthrough technologies, mentioning initiatives like the NATO Innovation Fund and the European Innovation Council. You can access the session here.

The event was a great opportunity to connect with old friends and engage in insightful discussions with new acquaintances. Discussions on female leadership in investment were also prominent, led by Erin Harkless Moore, Tonya Allen, and Sallie Krawcheck, moderated by Anna Mason. as well as the session on Institutional Investors, moderated by Christopher Ailman with Molly Murphy, Amy Diamond, Allison Hill, Bei Saville, Elizabeth Tulach. Thanks to Saleha Osmani in the session on investing in Qatar with Dr Mohsin Pirzada women's significance in venture and startups was also highlighted.

Global Summit of Woman in 🇪🇸 Madrid

Our team member, Kasia, attended The Global Summit of Woman in 🇪🇸 Madrid, where she experienced empowerment and collaboration among attendees from government, business, and entrepreneurship. The summit provided a platform for meaningful dialogue and action toward gender equality and female leadership on a worldwide scale, ranging from public-private partnerships to supporting well-being in the face of uncertainty.

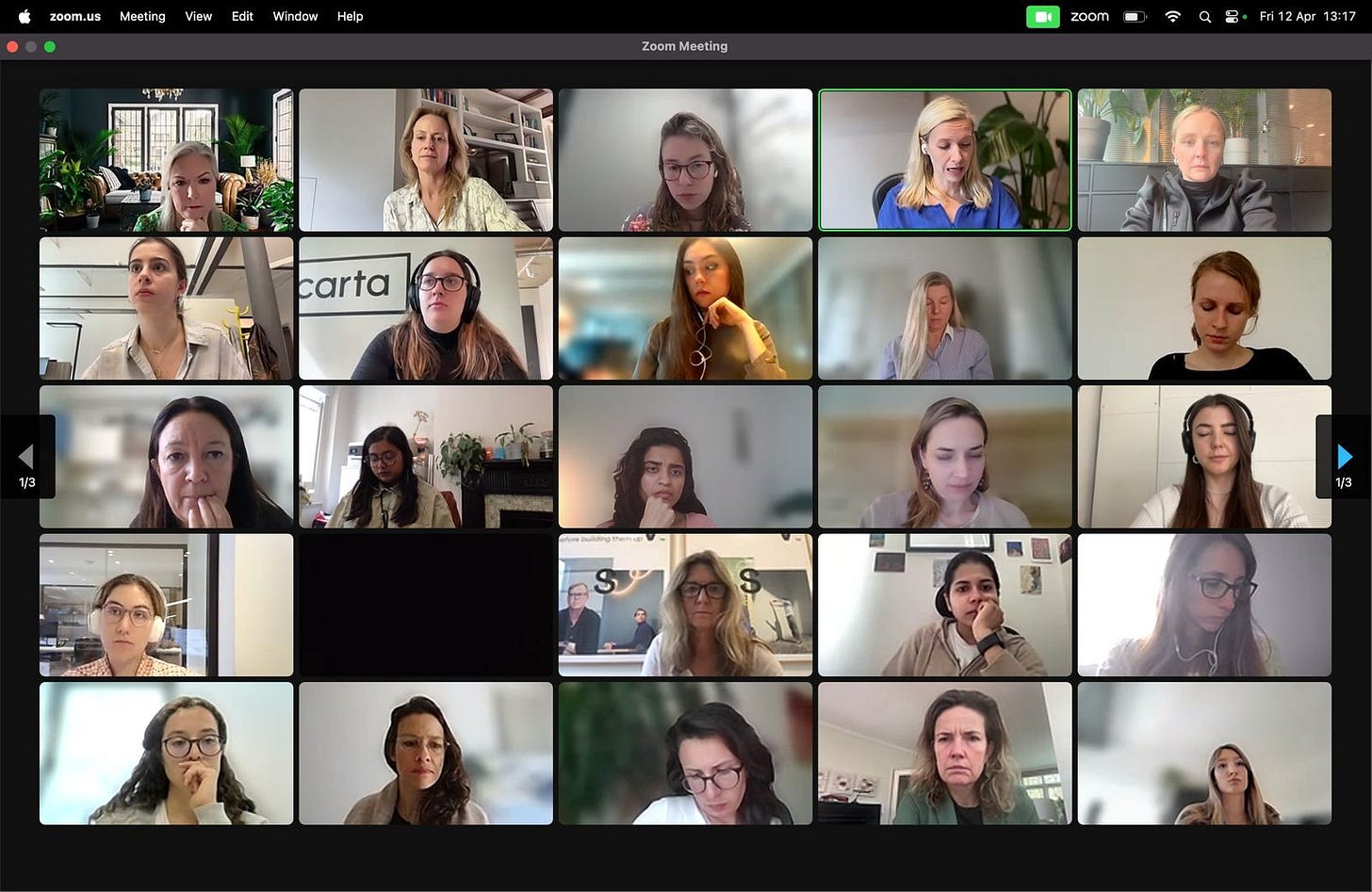

Online events 🖥️

As part of our Lunch & Learn series, we hosted a discussion on April 12th, where we were joined by Heidi Lindvall of Pale Blue Dot from 🇸🇪 Sweden, Machtelt Groothuis of Rubio Impact Ventures from 🇳🇱 Netherlands, and Zoe Peden of Ananda Impact Ventures from 🇬🇧 UK/ 🇩🇪 Germany. Among many topics discussed, we had:

Impact investing in European venture capital.

The external impact of the advisory board.

How to ensure impact drives the entire value chain?

The climate thesis and value alignment with stakeholders and LPs.

We concluded our meeting by highlighting the core challenges in 🍀 climate change and that new and emerging VC funds need more capital at the fund of funds level.

You’ll find us and our members next 🧳 at:

Iceland Innovation week, May 15 to 16th 🇮🇸 in Iceland.

MENOPAUSE 2.0, May 16th, 🔗 Online.

A global virtual conference about menopause and all things women’s health - Organized by Women of Wearables.

Latitude 59, May 22 to 24th in 🇪🇪 Tallin.

Discount code [EWVCxL59] for 20% discount on tickets.

Dublin Tech Summit 2024, May 29-30th, in 🇮🇪 Dublin.

Reflect Festival May 30-31st in 🇨🇾 Cyprus - Join the coolest tech crowd and mingle with 250+ investors. Get your FREE Startup Passes.

French Tech Barcelona Impact Summit, May 30, in 🇪🇸 Barcelona.

Discount code [WOMENVC] for €10 discount on tickets. Register here.

⭐ SuperVenture, June 4 to 6th in 🇩🇪 Berlin - We’ll be hosting a side event on the 5th of June, a GP/LP Lunch.

✉️ Contact us to get an exclusive invitation.

Discount code [FKR3549WOMENVC].

SuperReturn - Women in Private Markets Forum 2024, June 3rd, in 🇩🇪 Berlin - Top-level networking event for senior women in private markets.

LTST 2024, June 5 to 6th in 🇦🇹 Vienna.

Discount code [EWVC20]

South Summit, June 5 to 7th in 🇪🇸 Madrid - an annual gathering of the key players in the European entrepreneurial ecosystem.

Perspektywy Women in Tech Summit, June 12 to 13th in 🇵🇱 Warsaw.

🚀 2 days full of knowledge and career opportunities

🚀 5 stages with inspiring speeches and lectures

🚀 150 speakers and special guests

🚀 60 upskilling workshops

🚀 500 individual mentoring sessions

🚀 100 booths of the most innovative global companies

✉️ Contact: k.piasecki@perspektywy.pl to get a free ticket.

Take your friends to come to Warsaw this summer!

Global Investor Summit, June 13 to 14th in 🇵🇱 Gdansk. 35 years after the fall of communism in the first free democratic elections President Walesa will try to answer the question: Is democracy worth investment? - as part of his keynote.

✉️ Contact: monika.hommel@efcongress.com for details.

London Tech Week, June 10 to 14th in 🇬🇧 London - a place where visionaries, investors, and founders meet with enterprise tech leaders to find new cycles of tech innovation.

InvestHer Summit, June 19-21st in 🇮🇪 Dublin. The team is on a mission to get 1M women entrepreneurs funded by 2030.

World Venture Forum 2024, July 1st in 🇦🇹 Austria, brings us to the 10-Year Anniversary of the event.

What we are reading 🤓 and listening 🎧 to:

It's time for the 'middle powers' to step up on geopolitics.

Guest: Susana Malcorra, Senior Advisor at Spain’s IE University and former Argentinian foreign minister and UN Secretary General Chief of Staff.

“We're living in a world in which the scale of distrust among the top powers is extremely high. This is not a world where cooperation, just as it's been over the last 30 years or so, is going to cut the mustard.”

Tune in on World Economic Forum.

Why Spotify's Daniel Ek hired people with "no track record".

Guest: Sophia Bendz, formerly global marketing director at Spotify, actual GP at Cherry Ventures.

“I would love to see more female investors in the cap tables. As a founder you should use your cap table to gather as much diversity as possible in your cap table because multiple perspectives can help you along the journey.”

Tune in on Startup Europe — The Sifted Podcast.

Angel investing with Mikko Silventola, Bolt's and Hugo's First Investor

Guest: Mikko Silventola, Bolt's and Hugo's First Investor.

“I try to keep my head up and think that the upcoming years will be better than what we are currently living. Additionally, what I am also thinking is that if I want to continue and stay in this space, and find the best deals, I have to keep doing them.”

Tune in on EUVC.

You might also like 📚👀

VCs are having a negative impact on the founder's mental health.

A new Sifted survey shows that 71% of startup founders feel like their relationships with their investors have gotten worse, not better. These times call for better assistance in fundraising and connecting with new investors, favoring genuine support over micromanagement.

Read the article on Sifted.

Cathie Wood’s Ark Venture Fund invests in OpenAI.

“OpenAI is at the forefront of a Cambrian explosion in artificial intelligence capability,”

Cathie Wood’s Ark Investment Management has announced that it proudly invested in OpenAI.

Read the article on Bloomberg.

Fertility startups to watch, according to investors.

One in six people globally are affected by infertility, showing us why we need to create accessible, affordable and high quality fertility solutions.

Sarah Finegan at Antler, Mascha Bonk at Ananda Impact Ventures, and Javier Nunez-Vicandi from Sofinnova shared their top startup recommendations.

Read the article on Sifted.

"Can you name a female CEO?"

A viral campaign launched by Fortune on Tiktok highlighting what we still need to work on in 2024.

We're a squad of over 1000 senior female venture capital wizards from all over Europe and beyond. We're here to flip the script and make things right.

Join us in shaking up the VC world! 🚀

See you soon,

European Women in VC

Follow us on LinkedIn