📬 EWVC June: 🔗 The Strategic Link Europe Is Overlooking.

The Quiet Power of Fund-of-Funds: Why Now Is Their Moment. Let's dive deeper.

We deliver in-depth research, but your inbox may limit our message. To read the full newsletter, please access it through the Substack app here.

Quote of the day: "The only way to do great work is to love what you do."

— Steve Jobs, Entrepreneur, Founder of Apple.

Women’s Venture Capital Summit Europe

Use links with discounts code (EWVC) applied for With Intelligence events:

Women’s Venture Capital Summit Europe - use this link.

Women’s Private Equity Summit Europe - use this link.

€800 billion. 💸 That is the amount of investment that Europe needs to close the competitiveness gap with the US and China, according to Mario Draghi’s estimates.

This realisation unfolds two questions:

Where to find that money?

And, how to make sure it is catalyzed to innovation and new businesses?

💡Europe’s Big Problem (or Opportunity)

Europe has the talent but lacks local funding to finance its next unicorns. Fragmented and underfunded VC markets, combined with limited institutional investment backing alternative assets, fuel dependence on foreign capital - and the risk of losing top talent abroad.

Amongst this “lack of funding” problem. A core issue identified is the insufficient involvement of institutional investors, such as pension funds and insurers, in funding European VC funds, particularly at later growth stages. Governments are not enough anymore. As an example, 30% of the EU budget is spent on climate change today, which represents until 2027 a total of €87 billion. According to European auditors, this sum represents less than 10% of the investment needed to reach the 2030 targets the EU set for its transition, with real needs around one trillion euros per year.

The conclusion is that, while government funding has played its role in Europe up until now (EIF, KFW, Bpifrance, amongst others); tougher economic situations in the continent are slowing down their efforts.

💡The share of global VC funds raised in the EU is only 5%, compared to 52% in the US and 40 in China.

Europe’s private fund-of-funds market remains significantly underdeveloped. Unlike in the U.S., European universities lack sizable endowments or foundations with the capacity to invest in venture and growth funds. The gap can be bridged by institutional investors who could pool, manage and invest sufficient amounts - into private fund of funds.

These investors have never fully bet on capital risk: despite progress, the share of alternative assets under management (AUM, for which institutional investors account for 31% 28) into European VCs has declined in the past two decades. Today, 8% of European asset manager allocation in alternative assets are in venture capital, which is half of the US average of 16%.

💡Former ECB President Mario Draghi’s landmark report warned Europe urgently needs more investment to stay globally competitive. FoFs are becoming the policy tool to mobilize Europe's massive savings into innovation.

Europe is suffering from:

💸 Capital Shortage: European institutional investors contribute only ~30% of VC funding versus 72% in the US (France Digitale).

📉 Small Scale: Between 2013-2023, Europe produced just 11 billion-dollar VC funds compared to 137 in the US (EIB Report).

🔗 Lack of institutional investors: Government funding alone does not suffice. Only 0.024% of European pension fund assets are invested in local VCs, highlighting enormous untapped potential (France Digitale). With very little investing from university endowments and foundations, privately managed fund of funds are a must for Europe.

European Competitiveness, Wake-Up Call 📣

While European household savings amounted to EUR 1,390 billion in 2022 compared to EUR 840 billion in the US, EU households have considerably lower wealth, with net household wealth increasing by only 55% in the EU between 2009 and 2023, compared to 151% in the US. This gap is largely attributed to less efficient financial intermediation and the fragmentation of capital markets.

The annual additional investment needed for the EU is estimated at EUR 750-800 billion, representing 4.4%-4.7% of EU GDP.

In 2023, venture capital investment in Artificial Intelligence (AI) in the EU was USD 8 billion, significantly lower than USD 68 billion in the US and USD 15 billion in China.

Europe has fewer and less equipped large-scale VC funds, with only 11 funds larger than USD 1 billion since 2013, compared to 137 in the US.

Pension funds are "significantly underdeveloped" in much of the EU, with assets at 32% of GDP in 2022, vastly lower than 142% in the US and 100% in the UK.

🔑 Fund-of-Funds: The investment case

FoFs can be a safer entry into venture and growth capital, especially attractive for pension funds, insurance companies, and other institutional investors under-exposed to VC because of their risk profile.

🌍 Diversification: A single FoF can provide exposure to 20 or more VC funds, significantly reducing the risk compared to direct investments (Pattern Ventures).

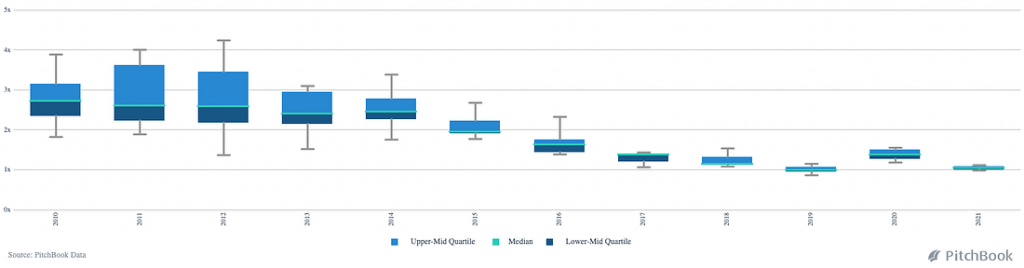

📈 Stable Returns: With less volatility, FoFs help investors smoothly navigate the notorious venture "J-curve”, implying a clear de-risked way to participate in VC as the portfolio of the underlying fund mitigates poor performance of single assets, if applicable.

🧠 Expert Management: Professional teams handle selection and due diligence, helping LPs achieve net returns that rival direct VC fund investments.

💡Median returns (TVPI) for venture FoFs historically average around 2.5×, typically without loss of principal (LevelVentures).

Venture Capital Fund-of-Funds TVPI by vintage.

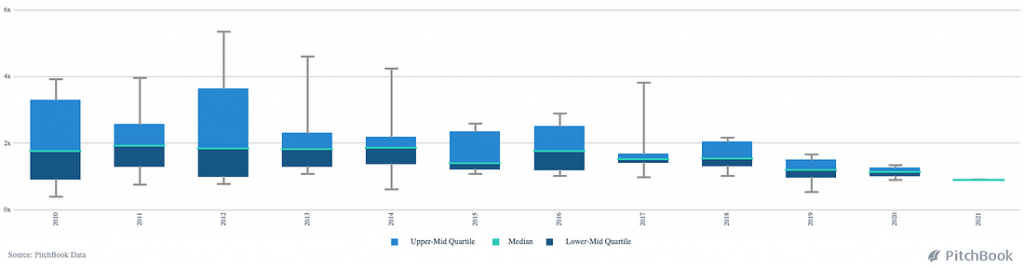

Venture Capital Direct Funds TVPI by vintage.

Pros and cons of FoFs versus VCs

✅ Pros of FoFs (From an LP perspective)

🔐 Superior Access: Access to top-performing and exclusive funds that are often closed to new LPs.

📉 Lower Return Dispersion: FoFs has a 0.58x spread (top to bottom quartile), while direct VC has a 1.21x spread.

💰 Fees Are Justified in VC: Top 5% of VC funds outperform the median by ~45%, while in hedge funds, it’s only ~10%. The gap absorbs the second fee layer.

⏱️ Cost & Time Efficiency: FoFs fees can be cheaper that paying the Management team, plus it is operationally simpler.

Typical Cons of FoFs, according to LPs

💸 “Double Layer of Fees”: A typical objection is that fees eat into returns. The reality is that VC’s return dispersion is so high that FoFs still outperform direct VC net of fees. FoFs are a lower risk, consistent return option.

🤷♂️ Signals Weakness or Inexperience: Many consider that using a FoF means the LP can’t execute a direct VC strategy. Actually, most LPs are generalists; choosing a FoF shows smart delegation and a focus on performance.

📊 Less Fun or Less Prestige: Direct VC investing is more engaging and high-status. However, top FoFs host curated LP/GP events, intros, and experiences that enrich the LP journey.

Closing thoughts 🎉

Fund-of-Funds represent a powerful strategy for Europe to harness institutional capital, drive innovation, and enhance competitiveness. With targeted policy support and savvy investors recognising their potential, FoFs can transform Europe's fragmented funding landscape into a powerhouse of global innovation. The benefits outweigh the drawbacks, especially for institutional investors looking for reduced risk, but looking for good assets that can, as a side benefit, catalyze innovation.

🎯 Key Takeaways: we need to develop all asset classes in Europe!

FoFs offer critical diversification and stability, especially suited to cautious institutional investors.

Europe requires €750-800 billion in additional investment annually to close its competitiveness gap with the US and China (approximately 4.4%-4.7% of EU GDP). In this context, Europe needs FoFs to unify fragmented markets and unlock vast institutional savings.

The European VC share is only 5% of the global total, compared to 52% in the US and 40% in China, highlighting the need for stronger local funding.

European VC funds have been much smaller compared to the US, with only 11 funds over $1 billion between 2013-2023, versus 137 in the US.

The European pension fund market remains underdeveloped, holding only 32% of GDP in 2022, far behind the 142% in the US and 100% in the UK, indicating untapped capital potential for VC investments - are fund of funds the way to accelerate the deployment?

FoFs offer superior access to exclusive funds, with lower return dispersion (0.58x spread vs. 1.21x for direct VC), and their fees, though higher, are justified by higher returns from top VC funds.

Europe must strengthen its entire venture capital stack - and that means developing all asset classes. Public capital has a critical role to play in accelerating the growth of private fund-of-funds structures, to act as LPs to Europe’s VC ecosystem.

📚 Want to learn more? Check the articles below! 💡

Empowering Equity 2025 – Register Now!

Are you an LP or a GP looking to make an impact through gender-smart investing? This is your opportunity to join the movement shaping the future of equity and inclusion in Europe.

🙌🏼 People who inspired us lately

Michelle Kang

Michelle Kang, Self-made Tech Entrepreneur, Leader and Billionaire.

Michele Kang is the owner and CEO of the Washington Spirit, a professional women’s soccer team in the NWSL. She became the team’s controlling owner in 2022 and has since led major efforts to professionalize and invest in women’s sports. In 2023, Kang launched the first-ever global women’s soccer holding company, bringing together teams across Europe and the U.S. to elevate investment in the women’s game.

👉 Read more here.

Sophie Purdom

Sophie Purdom, Self-made Tech Entrepreneur, Leader and Billionaire.

Sophie Purdom is the founder and Managing Partner of Planeteer Capital, a New York–based early-stage climate tech VC firm targeting Pre‑Seed and Seed investments in hardware-enabled software companies tackling carbon management, decarbonization, climate intelligence, and sustainable agriculture

👉 Read more here.

🤑 Latest Fund News

Incofin has a new €61m Water Access Fund! 👏

Incofin Investment Management's Water Access Acceleration Fund reaches €61m final close as first private equity fund dedicated to water access. Targeting Africa, Asia, and Latin America, the blended finance initiative aims to deliver 20 billion litres of water to 30 million people through scalable water businesses.

👉 Read more here!

Funding news⚡

Nabla raises new round!

Industry: Healthtech AI | Location: 🇫🇷 France | Funding: $70M Series B

French healthtech startup Nabla, co-founded by Delphine Groll, has raised a $70 million Series B round led by HV Capital. Nabla develops AI-powered tools for medical professionals to streamline clinical documentation and improve patient care.

👉 Read more here.

Sifflet raises Series A extension.

Industry: Data Infrastructure | Location: 🇫🇷 France | Funding: $18M Series A extension

Sifflet, a French data observability platform co-founded by Salma Bakouk, announced an $18 million extension to its Series A round. The investment comes from existing backers EQT Ventures and Mangrove Capital Partners, supporting the company’s growth in the enterprise data quality space.

👉 Read more here.

🎧📚 What are we reading and listening to?

🚀 Bloomberg × Founders Forum Europe’s startup list!

🗣️ DeepL (DE) – ultra-precise machine translation

🎮 Dream Games (TR) – Royal Match dethrones Candy Crush

🚚 Einride (SE) – autonomous electric freight trucks

🛰️ Isar Aerospace (DE) – Europe’s answer to SpaceX

🧬 Cradle (NL/CH) – AI-designed proteins at lightning speed

👉 Read the full list here!

What we have been up to? 🎉

🇮🇹 Women in VC - Chapter Italy

Kasia Piasecki participated in an event held in 🇮🇹 Milan, where she spoke about gender bias in investments and presented the latest report findings. While Italy has seen a growing number of women entering the venture capital space, significant gaps remain in visibility, support, and representation. We were proud to be part of this important milestone. Thank you to Laura Morelli for an invitation!

20th Anniversary of Founders Forum, 🇬🇧 London Tech Week

Founders Forum Global brings together the very best in global tech, including trailblazing unicorn founders, top CEO, and world-class VCs. Kinga Stanisławska had a pleasure of being a part of 20th Anniversary of Founders Forum at Tate Modern! Congrats to Brent Hoberman, Carolyn Dawson and entire Team!

We were also a part of 🇬🇧 London Tech Week, which unites the global tech ecosystem in one place. It brings together the innovators creating the technologies of tomorrow, the investors funding them, and the enterprise leaders who will adopt them. The highlight was definitely fireside chat of Luciana Lixandru with Beatrice York. Thank you for having us!

Attend one of our partners’ events 🎟️

TechBBQ, August 27-28th, 🇩🇰 Denmark

How to Web, October 1-2nd, 🇷🇴 Bucharest

10% discount code: BUILDERS

VDS, October 22-23rd, 🇪🇸 Valencia

Apply for a free attendee pass - info@europeanwomenvc.org

0100 International, October 27-29th, 🇮🇹 Milan

15% discount code: EWVC

SuperReturn Europe, November 04 - 07th 🇳🇱 Amsterdam

10% discount VIP code: FKR3623EWVC

SuperVenture North America, November 19th, 🇺🇸 New York

10% discount VIP code: FKR3637EWVC

SLUSH | European Women in VC, LP-GP Breakfast | Women & Men Allies in VC

19 November, 🇫🇮 Helsinki

Register here: https://lu.ma/u0zjcjri

We're a squad of over 1000 senior female venture capital wizards from all over Europe and beyond. We're here to flip the script and make things right.

Join us in shaking up the VC world! 🚀

Join us as member, partner or ally | Book a meeting

Take care!

European Women in VC

Follow us on LinkedIn