📬 EWVC July Newsletter: Are family offices betting on Europe's future?

Welcome to our latest newsletter edition, exploring how family offices are positioning themselves for Europe's future.

Quote of the day: "To bring about change, you must not be afraid to take the first step. We will fail when we fail to try." Rosa Parks, American activist.

Dear Friends of European Women in VC,

Traditionally overlooked, family offices are now recognized for their substantial contributions, with an estimated 10,000 managing trillions in wealth. According to the UBS Global Family Office Report 2023, one strong sign coming from them is their plans to have the largest strategic asset allocation shift in years due to changes in interest rates, inflation, and economic growth.

Family offices were reluctant to invest in ventures for a while. In many European countries, family offices allocate a surprisingly small portion of their venture investments. For example, in 🇨🇭Switzerland, only 2% of their assets go to PE funds, and the same amount is allocated to arts and antiques.

Another factor influencing progress might be that many family offices make the mistake of trying to minimize venture capital risks in ways that contravene their inherent high-risk, high-reward nature. They act as "tourists" in venture capital, entering the market in upswings and quickly exiting after facing losses. According to Ertan Can, founder of Multiple Capital, this cyclical participation can lead to missed opportunities.

However, things are slowly changing. After The Tech Reset from the European fundraising market, companies staying private for a longer period of time, and venture becoming one of the best-performing asset class, it seems their interest in this asset class increased.

Family offices are becoming an active LPs in the European venture ecosystem and the backbone of global economies, according to Sonia Tatar.

Additionally, we see more family offices becoming VCs, or actively considering it for their portfolios. For example, Alexander Getty, from Getty Family Offices, is just one of the family offices that confirmed this recently.

“The primary reason we’re in venture is to make a difference. When we first got into venture, we were happy to wait for 10 years for outsized returns. Now, the returns are better and realised sooner, but that’s just a byproduct.

Investing in impact-driven startups isn’t an option anymore; it’s a necessity. It’s imperative that the money goes in now, but also from a returns standpoint, you’d be foolish not to look at these investments. The risk isn’t the money you invest in VC funds, but the fact that the investments we considered great investments in the past 10 years - fossil fuels, oil, and gas - will be forced to change.”

Family offices are increasingly aligned with positive impact investing and are prioritising sustainability in their allocations. However, they currently account just for 4% of the impact investing ecosystem.

“Impact funds are growing in size and scope, attracting family offices and institutional investors, who see growing opportunities to make sound investments with sound financial returns.” says Shiva Dustdar, Director and Head of EIB Institute at European Investment Bank in European Women in VC 2024 report.

We write about impact investing because it aligns perfectly with the values and goals of many family offices. They often seek to leave a positive mark on the world alongside achieving financial returns, and impact investing allows them to strategically allocate their wealth towards initiatives that generate measurable social and environmental benefits alongside financial gains.

When we discuss impact, diversity naturally follows. According to KPMG’s 2023 Global Family Office Compensation Benchmark Report, only 21% of family office professionals are women.

Times are changing, and as more women become wealth holders in the family, we have more professionals active in this sector. According to Mischon de Reya, we expect that 60% of the UK's wealth will belong to women by 2025.

Family offices are evolving from passive bystanders to active participants, and their long-term investment horizons and growing interest in impact investing make them ideal partners.

This shift presents a significant opportunity for us. As a champion for diversity and inclusion in the industry, we are well-positioned to connect these new players with those who are leading the way in building a better future.

🙌🏼 People who inspired us lately

🔥 Catherine Fletcher

SCVC has announced Dr Catherine Fletcher, a Research Scientist who joined the firm at its inception four years ago, as its new Partner.

“I am delighted to have made it to this position where I can make a real difference. I’m passionate about encouraging more women and people of different backgrounds to pursue alternative career paths like I have. I’m super proud of everything we have achieved to date, but most importantly looking forward to the bigger and better achievements that are looming in the not too distant future!”

Find out more here.

🔥 Janneke Niessen

Janneke Niessen started CapitalIT five years ago, with a strong idea that investing in the best founders would results in a diverse portfolio. She shared her journey and thoughts on why gender equity matters in European venture capital in a recent article for Forbes.

Read the article here.

🔥 Triin Linamagi

Triin Linamagi, founder and CEO of Sie Ventures, wins Angel Group of the Year at UK Business Angels Association Investment Awards 2024, as being the most active and impactful angel investors group in the 🇬🇧 UK!

Read more about the news here.

🔥 Isabel Fox

Molten Ventures just welcomed Isabel Fox as their new Head of Third Party Funds, to make further progress in building its third-party assets under management and associated income.

Read the full story here.

🔥 Miray Topay

L Catterton, a leading global consumer-focused investment firm, announced the appointment of Miray Topay as Partner and Head of the firm's London office.

Read the full story here.

Fund News 🤑

BrightCap Ventures announces the closing of Fund II at €60M.

🇧🇬 Bulgaria-based, BrightCap Ventures completed the first close of their €60M successor fund aiming to focus on Future of Work, Digital Health, and Fintech, with initial tickets ranging from €0.4m to €3m.

Read the full story here.

KfW Capital has made its first investment in Nucleus Capital.

🇩🇪 Germany-based, Nucleus Capital secured EUR 6.5 million from KfW Capital via the Emerging Manager Facility of the Federal Government's Future Fund. Nucleus Capital, led by Dr. Isabella Fandrych and Maximilian Schwarz, invests in startups and tech companies in Programmable Biology, Food Technology, and Green Industrials.

Read the full story here.

Seaya closes €300M climate-tech fund - Seaya Andromeda.

🇪🇸 Madrid-based Seaya, founded by Beatriz Gonzales, closes the first Article 9 climate-tech fund based in Southern Europe — at €300M, to invest in impact-driven growth companies specialising in energy transition, decarbonisation, sustainable food value chain, and circular economy.

Read the full story here.

Frumtak Ventures announces the closing of Fund IV, oversubscribed at €87M.

🇮🇸 Reykjavik-based, Frumtak Ventures just announced the closing of an oversubscribed Fund IV at €87M aiming to invest in local innovation with global potential.

Read the full story here.

Leading by example ✨ portfolio champions ✨

Greencode Venture invests in ZeroMission.

🇮🇪 Ireland-based ZeroMission, founded by Leah O’Dwyer, raises €2.8m to drive electric vehicle fleet management platform and to further expand in Europe and the US from Greencode Ventures, led by Dr. Terhi (TJ) Vapola.

Read the full story here.

Jade Ventures’ portfolio company EVE - Electric Vehicle Ecosystems is an e-mobility intelligence company building the leading e-mobility and sustainability data ecosystem, leveraging granular data insights to achieve a carbon-neutral future.

EVE has already conducted product market fit with successful pilots with fleets in Germany and Portugal, including Portugal's largest transport company, by successfully reducing their electrification cost by 40% and demonstrated savings potentials of up to €1.4m annually for a fleet of 1,000 vehicles. Already revenue generating, they currently built out a strong lead pipeline worth €1.5m including €500k in active tenders. We can’t wait to see more of what they innovate and impact!

Sarah Marie Rust is the founder and CEO of EVE, and she recently won the InterTradeIreland Seedcorn Finale as the regional winner from Dublin.

Watch an interview with Sarah here.

Austrian AI startup - Prewave raises €63M Series B round.

🇦🇹 Austria-based Prewave, co-founded by Lisa Smith, raises a €63M a Series B round led by Hedosophia to enhance supply chain sustainability and compliance. The round also saw participation from Creandum, Ventech, Kompas, Speedinvest, and Working Capital Fund.

Read the full story here.

This is what we’ve been up to 🤸🏽♀️

Global VC Allocator Alliance Pitch event.

Kinga Stanislawska, from our team, shared market insights and recent data on the state of Europe of women in VC from our recent report:

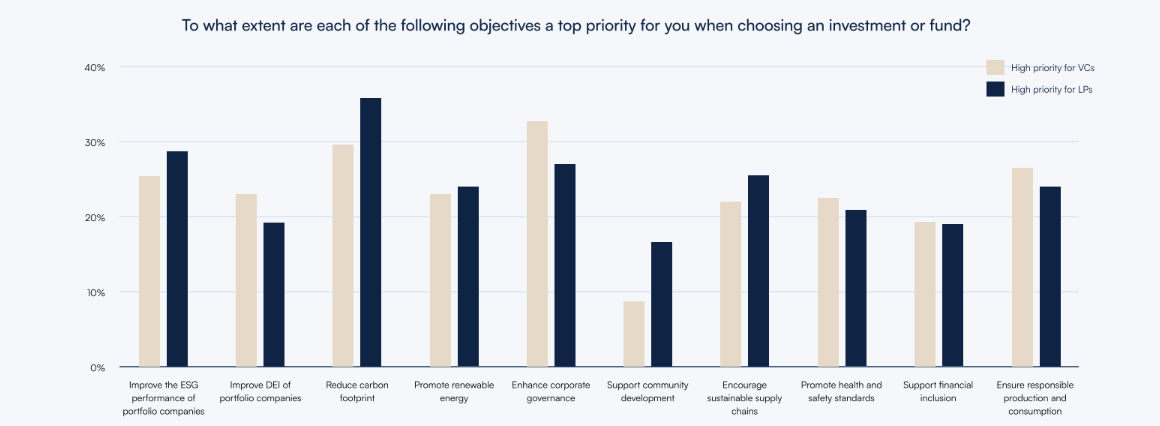

𝗗𝗶𝘃𝗲𝗿𝘀𝗶𝘁𝘆 𝗯𝗼𝗼𝘀𝘁𝘀 𝗿𝗲𝘁𝘂𝗿𝗻𝘀: Each 10% increase in women's representation in senior VC management is associated with a 1.3% increase in IRR.

𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝘆-𝘄𝗶𝗱𝗲 𝗯𝗲𝗹𝗶𝗲𝗳: 9 in 10 VCs and LPs surveyed say increased diversity in venture capital leads to better investment decisions and financial returns.

𝗪𝗼𝗺𝗲𝗻 𝗩𝗖𝘀 𝗱𝗿𝗶𝘃𝗲 𝗶𝗺𝗽𝗮𝗰𝘁: 1 in 3 women VCs and LPs prioritize enhancing corporate governance and reducing carbon footprint when investing.

We also had the pleasure of hearing insights and discussing with four other inspiring women-led VCs about their funds and strategies. Leanox Impact Capital, Cherryrock Capital, Greencode Ventures and Overwater Ventures.

What does data tell us about women's angel investment?

We were very excited to join this panel discussion organized by ESIL, where our colleague Kinga shared data from European Women in VC latest report emphasizing the importance of increasing women investors as decision-makers and leaders.

She discussed applying these insights to develop the angel ecosystem in 6 ESIL target countries with other panelists Henry Whorwood, Managing Director Research and Consultancy, Beauhurst, and Laurence COHEN, Associate professor in finance, iaelyon School of Management. The conversation was moderated by Reginald Vossen, CEO at Business Angels Network Flanders, and President at Business Angels Europe.

Support your favorite women at Growth Investor Awards.

EWVC joined the advisory panel on Growth Investor Awards and leads the introduction of three new categories for Investing in Women:

Exit of the year - celebrates outstanding achievements in exits where investment has significantly supported female entrepreneurs or women-led businesses.

Team of the year - recognises the outstanding efforts of investment teams within venture capital (VC) and private equity (PE) firms that have demonstrated exceptional dedication to supporting women entrepreneurs.

Initiative of the year - honours innovative initiatives undertaken by investment firms to promote gender equality and support women entrepreneurs.

You can submit your entries here, and join the black-tie ceremony from London Hilton on Park Lane on November 21, 2024.

What we are reading 🤓 and listening 🎧 to:

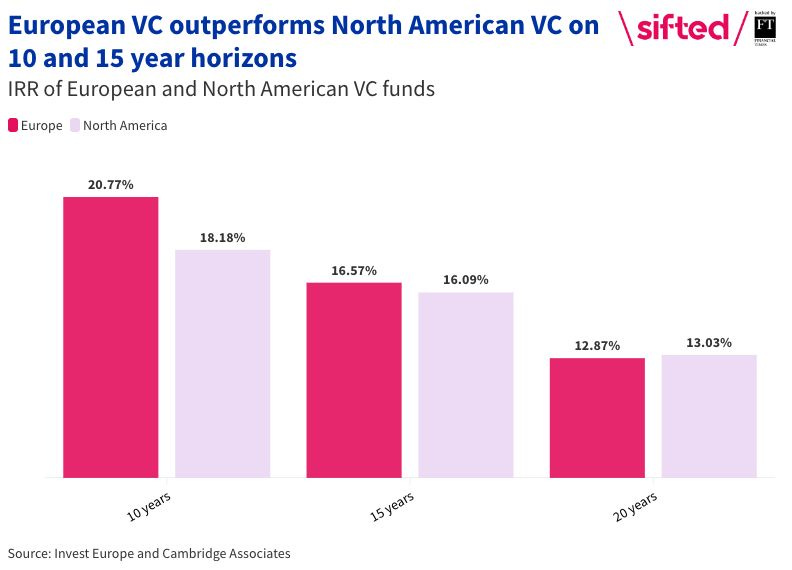

European VCs outperform US VCs over 10 and 15 year horizons

A new report from Invest Europe, leveraging data from Cambridge Associates, reveals that European VC returns have outperformed North American VC returns over the past 10 and 15 years.

The findings show European VC funds achieving a 20.77% net IRR over 10 years, compared to 18.18% for North American funds. Over 15 years, European VC funds also lead with a 16.57% IRR, surpassing North America's 16.09%.

Read the full article here.

European Crossover Investment Report by Revaia.

The latest edition of Revaia’s report reveals that while Crossover Investing has made important progress amid recent volatility. The sector remains stronger than it was before we had an influx of external investment.

Crossover investors invests in both publicly-traded and privately-held companies, and 2023 brought a high interest from this sector of investors in European startups.

Read the report here.

Endowment investing with University of Chicago’s Joanna Rupp.

Joanna Rupp, Managing Director of Private Equity at the University of Chicago was a guest in the Origins Podcast and had an inspiring discussion with Nick Chirls from Notation Capital and Elizabeth Beezer Clarkson from Sapphire Partners the often opaque world of endowments, including what separates an endowment from a foundation, how they consider small funds v. big funds and the fallout from an avalanche of capital being thrown at VCs.

Listen to the podcast episode here.

Why you need talent, money, and network to build a great ecosystem

Giulia Van Waeyenberge Managing Director at Sofina and an active LP in female (co-)led funds such as Seedcamp, Dawn Capital, Balderton Capital and Blossom Capital talks about the key ingredients you need for a great ecosystem, why Europe is maturing and how to include ESG and sustainability in your investments at the EUVC podcast.

Listen to the podcast episode here.

How to get the world’s top investors onboard?

Sabina Wizander, Partner at Creandum talks about Europe's on the rise, ready to produce fantastic companies and outcomes, the power of thinking like an owner and maintaining a long-term perspective, and many other exciting topics in the EU-startups Podcast.

Listen to the podcast episode here.

You might also like 📚👀

Greencode Ventures launches its first Annual Impact Report.

The report details their impact and ESG approach, sustainability performance, investment deep dives, and their own footprint and ecosystem impact.

Read the report here.

Borski Fund activity in 2023 - part of StartGreen Capital Impact Report.

In 2023, Simone Brummelhuis, Co-founder and Partner of Borski Fund has actively contributed to bring more diversity in the venture ecosystem. She invested in 5 new start-ups and 7 follow-on investments, and is always on the lookout for new leads. Together with her team they hosted over 160 coffee hours to meet with women-founded ventures in search of capital.

Read the report here.

VCs at the forefront of tech-driven societal change.

EIT Digital celebrates the impressive growth of the European tech ecosystem, now valued at €3.5 trillion, more than doubling in the past five years.

Read the article here.

Balderton introduces parental support for founders.

🇬🇧 UK-based, Balderton Capital is introducing parental support for founders, becoming the first VC firm to offer free access to Cooper Parenting.

Read the full story here.

Meet our team 🧳 at:

Baltic VCA Summit, September 5-6th, 🇱🇹 Vilnius

15% discount on tickets. Use code: LTVCA_Group

a. Investing in Positive Outcomes VC/PE and LP breakfast, September 5, 🇱🇹 Vilnius

TechBBQ, September 10-12th, 🇩🇰 Copenhagen

Nordic Investor day, September 10th, 🇩🇰 Copenhagen

LP/GP Breakfast at TechBBQ, September 11th, 🇩🇰 Copenhagen

Women VC & Angel Investor Meet-up at Tech BBQ, September 11th, 🇩🇰 Copenhagen

SLUSH, November 19-21th, 🇫🇮 Helsinki - More details to follow!

Attend one of our partners’ events 🎟️:

Valencia Digital Summit (VDS), October 23-24th, 🇪🇸 Spain.

We have a few free tickets available, please contact us at info@europeanwomenvc.org to get one.

Fe:male Invest Summit 2024, November 6, 🇸🇪 Malmö.

10% discount on tickets. Use code: NFISxEUVC24

With Intelligence - Women's Venture Capital Summit, December 2nd-4th, 🇬🇧 Hertfordshire.

Discount available on tickets. Use code: EWC20.

We're a squad of over 1000 senior female venture capital wizards from all over Europe and beyond. We're here to flip the script and make things right.

Join us in shaking up the VC world! 🚀

See you soon,

European Women in VC

Follow us on LinkedIn