📬 EWVC February Newsletter: The Hidden Exit Routes 🚀

This month we are exploring secondary markets in Europe, and how to navigate the changes on the horizon.

We deliver in-depth research, but your inbox may limit our message. To read the full newsletter, please access it through the Substack app here.

Quote of the day: "You cannot change the world without taking risks".

— Chamath Palihapitiya, Venture Capitalist.

Join us for the upcoming Lunch & Learn session on March 7th at 13:00 CET (online) as we explore Dual Use & Defense Tech.

Secondary Venture Capital Markets: From Distressed Sales to Portfolio Management

The secondary market used to be crisis-driven (think: 2000 dot-com crash, 2008 financial crisis) when LPs needed emergency liquidity.

Now? It’s a strategic tool for optimizing portfolios, securing early returns, and managing fund life cycles.

Liquidity Crunch: Fewer Exits, More Secondary Demand

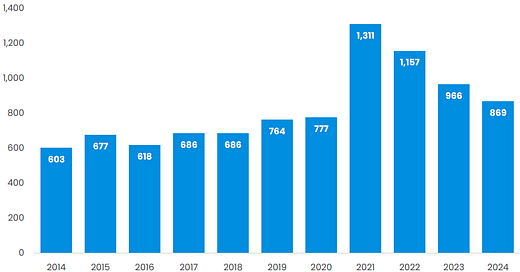

The European venture landscape has faced significant liquidity challenges over the past three years, largely due to a prolonged IPO drought and persistently high interest rates since 2022. These factors have made public market exits less viable, leading to a drop in the number of exits since 2021 and an increase in average hold times, which now exceed six years.

Number of Exits for VC-Backed Investments in Europe.

The implications of this liquidity crunch extend across the entire VC ecosystem. GPs struggle to return capital to LPs, who, in turn, face longer wait times and diminished returns. Founders are also affected, as fewer exit opportunities mean they must either achieve profitability sooner or seek alternative liquidity solutions.

Difficulties Arising from Liquidity Drought, in a Nutshell

🔒 Startups stay private longer → IPO timelines have doubled since the early 2000s, forcing early investors to seek liquidity.

🇺🇸 “The median time to IPO for VC-backed companies is now over 10 years.” – PitchBook

💰 VCs struggle to return capital → 2023 saw a 60% decline in VC-backed exits, pressuring funds to sell stakes.

🇪🇺 “Several of Europe’s biggest VCs have already begun making unannounced portfolio sales.” – TempoCap

📉 Economic uncertainty slows new investments → Higher interest rates and market volatility have reduced venture deal flow by 50% YoY.

“VC investment in 2023 fell to $285B, down from $630B in 2021.” – Crunchbase

🏦 Private equity enters the space → US buyers are aggressively acquiring secondaries, expecting valuations to rise in 2-3 years.

“It’s definitely a buyer’s market.” – Molten Ventures

Compounding these challenges, fundraising activity has sharply declined. The total capital raised by European VC funds fell from USD 37.2 billion in 2021 to USD 20.9 billion in 2024, while the number of new funds dropped from 447 to just 165 over the same period. This environment has forced VCs to adopt more conservative deployment strategies, further weighing on DPI—a key differentiator for survival—which has remained consistently low, even for older vintages.

Total Capital Raised by European VC Funds and Number of VC Funds Raised in Europe.

In response to these headwinds, several solutions can help (an are, actually, helping) generate liquidity in the venture ecosystem, even in a low-exit environment like the current one. GP-led transactions, including continuation vehicles, strip sales, and LP tenders, have gained traction as alternative paths to liquidity.

👉 This content is based on valuable insights from Ion Pacific, a global leader in the field of structured investments in secondary opportunities in the venture-stage technology sector. “By leveraging innovative transaction structures, we help GPs, LPs, and founders optimize their liquidity needs in challenging market conditions”. Special thanks to Kristaps Ronis, and Fabio Furlani from Ion Pacific for their contributions.

Navigating the current landscape: Secondary markets heat up

The VC secondaries market, as a result of the above, has experienced significant growth in both the U.S. and Europe, driven by the need for liquidity as traditional exits—IPOs and M&A—remain constrained. In the U.S., secondaries surged as large funds aggressively deployed capital to acquire stakes in promising late-stage startups. The market has matured, with players like StepStone closing a record $3.3 billion fund for VC secondaries in mid-2023. Europe, while historically lagging behind, has rapidly caught up.

💡Secondary transactions accounted for 24% of the global market in 2023, up from 18% in 2022 (Jefferies).

This surge reflects the growing demand from European VCs, LPs, and founders seeking alternative liquidity routes amid a challenging fundraising and exit environment.

👉 Industry Insights: "Secondary market participants are focused on the 30 largest global tech names. These highly intermediated names are traded with minimal to no discount based on very little company-level information. Outside the largest names, secondary markets remain incredibly inefficient, providing significant scope for traditional and non-traditional (preferred equity) secondary participants. There is over $4tn of global VC AuM of which +80% is unrealised. It is impossible for IPO and M&A markets to totally absorb this backlog in a timely fashion, and secondary market growth is essential for the future of our industry.” — Alexander Branton, Nodem Capital.

The thirty-year evolution of secondaries in deal volume.

💡A new clause into contracts

Venture capital investors are increasingly incorporating a "portfolio sale clause" into funding agreements to enhance liquidity options. This clause permits VCs to sell their shares in a startup without triggering other investors' rights to block the sale or sell their own shares simultaneously, particularly when liquidating an entire portfolio (Sifted).

Top European Secondary Deals

💰 Revolut’s $1B Secondary Sale (2024) – Revolut enabled early investors and employees to cash out over $1 billion in shares as part of a liquidity event following its 🇬🇧 UK banking license approval.

Read more.📈 Moneybox’s £70M Secondary Liquidity Event (2024) – 🇬🇧 UK savings platform Moneybox allowed 26,000 investors to sell up to 10% of their holdings, nearly doubling its valuation to £550M.

Read more.📊 Oura’s Secondary Investment by Siena Secondary Fund (2021) – 🇪🇪 Estonia-based Siena Secondary Fund acquired a stake in Oura, which later doubled in valuation to $5B in 2024.

Read more.

💡 Upcoming IPOs to Watch in 2025

🌟 Stripe (Est. Valuation: $65B) – The long-awaited fintech IPO could revive public markets.

📊 Databricks (Est. Valuation: $100B) – The AI and cloud analytics giant is prepping for a blockbuster listing.

🛍️ Klarna (Est. Valuation: $8B) – The BNPL leader is expected to go public after years of anticipation.

🏦 Chime (Est. Valuation: $5B) – The digital banking pioneer could test the fintech IPO waters.

👗 Skims (Est. Valuation: $4B) – Kim Kardashian’s shapewear brand is one of the most talked-about IPOs in retail.

Summing Up ⚡

To win in this evolving market, investors must adopt a structured, flexible approach. Institutional players leverage deep networks and proprietary data to access premium deals, while others focus on structured transactions like strip sales and continuation funds to balance liquidity and upside potential. Investors who can accurately price risk, access exclusive deal flow, and offer creative liquidity solutions will have a competitive edge. With private equity firms and crossover investors entering the space, competition is rising, but the opportunities in secondaries remain strong for those who can navigate this rapidly shifting landscape.

The key takeaways are:

🇺🇸 U.S. leads in secondaries, with mega-funds like StepStone's $3.3B VC secondaries fund driving the market.

🇪🇺 Europe is catching up quickly, with secondaries growing to 24% of global volume in 2023 (vs. 18% in 2022).

📉 Liquidity needs are the main driver, as IPOs and exits remain limited.

🔄 Winning strategies include structured deals, access to insider networks, and a strong pricing framework.

⚖️ Competition is increasing, but opportunities remain for those who can adapt to shifting valuations and investor sentiment.

Want to learn more? Check the articles below!

1️⃣ How secondaries work.

2️⃣ GP-Led Secondary Transactions and Continuation Funds: Structuring Options and Tax Considerations.

3️⃣ Price concerns in secondaries.

🙌🏼 People who inspired us lately

Gloria Baeuerlein

Gloria Baeuerlein, Solo GP of Puzzle Ventures.

Gloria is the VC who raised Europe’s largest female-led solo GP fund of €21.5M. Her fund, Puzzle Ventures, is one of the first in Europe to be led by a female solo GP, focusing on B2B SaaS and fintech companies across Europe.

👉 Read more here.

🤑 Latest Fund News

Course Corrected has completed its first close exceeding €63M!

Course Corrected has successfully closed the first round of its second fund, exceeding €63 million. The Fund’s three GPs: Christine Ahlstrand, Katja Bergman and Kerstin Cooley, are all longstanding investors in the Nordic ecosystem, and founded Course Corrected in 2021 with the mission to invest in companies developing innovative solutions to address climate change. Investors include European Investment Fund (EIF), Saminvest AB, SEB Life and Pension Baltic SE, SEB Stiftelsen (SEB), and a Swedish Foundation.

Nina Capital’s €50M Fund III is here

🇪🇸 Barcelona-based Nina Capital has launched €50 million Fund III, increasing its total assets under management to over €100 million. The fund will back international healthcare startups with support from LPs like Seven Two Partners, family offices, and high-net-worth individuals across Europe and the USA.

🎉 & some other achievements!

We would like to congratulate Course Corrected, Nucleus Capital and Mudcake in their recent acceptance into the Blue Future Partners & Mountside Ventures Accelerator.

Funding news⚡

Solid IO Raises €800K to Transform Cancer Treatment!

Industry: Medtech | Location: 🇫🇮 Finland | Funding: €800K

Solid IO has successfully closed its first funding round, led by Nordic Science Investments and including funding from BSV Ventures, Helsinki University Funds and a private European investor, to accelerate the development of Solid IO’s tumor-on-chip platform. It’s a breakthrough technology that enables real-time, biologically relevant insights to guide personalized cancer treatment and immunotherapy advancements.

👉 Read more here.

Imperia raises €10M Series A!

Industry: B2B SaaS | Location: 🇪🇸 Spain | Funding: €10M Series A

Imperia, a Valencia-based SaaS platform specializing in supply chain management, has secured €10M in a Series A funding round co-led by Burda Principal Investments and Samaipata. This is Burda’s first investment in Spain.

👉 Read more here.

GaN Devices lands a €30.5m Series C!

Industry: Power Semiconductors | Location: 🇬🇧 UK | Funding: €30.5M Series C

Cambridge GaN Devices (CGD), co-founded by Dr. Giorgia Longobardi, secures a $32M Series C round led by a strategic investor, including British Patient Capital, to expand globally and advance energy-efficient GaN power devices.

👉 Read more here.

🎧📚 What are we reading and listening to?

Selma Meryem Peters on Vestlane ‼️

Private markets are evolving rapidly and inclusivity isn’t just “nice to have”. Selma, part of the European Women in VC team, gives her thoughts on diversity, challenges, and the impact of having more women at the decision-making table.

📖 Read the full piece here.

Breaking the Glass Ceiling in VC

Julie Castro Abrams sits down with Cheryl Beninga, an experienced venture capital investor and advocate for women entrepreneurs. Cheryl discusses her path in venture investing, her commitment to supporting women in the industry, and actionable tips for those aspiring to enter the investment space.

👉 Find out more here.

What we have been up to? 🎉

Lunch & Learn session on Venture Debt

After diving deeper into Venture Debt in January’s newsletter, nearly 100 participants joined us to gain insights into alternative financing instruments from experts: Fatou Diagne, Managing Partner & co-founder at Bootstrap Europe, Iwona Biernat, Investment Officer - Growth Capital & Innovation Finance at European Investment Bank (EIB), Luis Eduardo Pazmino, Credit Associate at Capchase, and the host Iwona Cymerman, Managing Partner at FundingBox Deep Tech Fund.

Empowering Equity: The Investor’s Table

We gathered a fantastic group of investors, both men and women, at the "Empowering Equity: The Investor's Table" dinner in 🇬🇧 London, where we shared insights, exchanged ideas, and built connections to shape the future of VC. Thank you to everyone who joined us, and our amazing partners Marriott Harrison and Carta for co-hosting this event with us.

Attend one of our partners’ events 🎟️

SuperReturn Secondaries Europe, March 10-11th, 🇬🇧 London.

Hear from 80+ expert speakers through data-rich presentations, lively panel discussions and interactive closed-door sessions. Key themes include GP-leds, LP-leds, fundraising, LP perspectives, continued growth and emerging potential for the European secondaries market.

10% discount on tickets. Use code: FKR3583EVC.

SuperReturn North America, March 17-19th, 🇺🇸 Miami.

Join the most senior professionals in private capital for three jam-packed days designed to elevate your experience to the next level.

10% discount on tickets. Use code: FKR3564EVC.

EU-Startups Summit, April 24-25th, 🇲🇹 Malta

0100 Europe, April 2-4th, 🇳🇱 Amsterdam.

15% discount on tickets. Use code: EWVC15.

The Spring Summit by Carta, April 10th, 🇬🇧 London

0100 Emerging Europe, May 14-16th, 🇭🇺 Budapest.

20% discount on tickets.

SuperVenture, June 2-4th, 🇩🇪 Berlin.

10% discount on tickets.

SuperReturn Climate & Energy Transition, June 2-4th, 🇩🇪 Berlin

Join 300+ key industry stakeholders, including 150+ GPs and 90+ LPs to discuss the best pathways to achieving 2050 goals.

10% discount on ticket. Use code: FKR3593EWVC

Women’s Day Alliance, March 10th, 🔗 Online

0100 Mediterranean, Dates to be announced soon, 🇮🇹 Milan.

We're a squad of over 1000 senior female venture capital wizards from all over Europe and beyond. We're here to flip the script and make things right.

Join us in shaking up the VC world! 🚀

Join us as member, partner or ally | Book a meeting

Take care!

European Women in VC

Follow us on LinkedIn

Sweet data! Your chart is on point, love seeing that progress.