📬 EWVC December Newsletter: Celebrating 2024 Milestones

As 2024 wraps up, we look back at the important achievements of our members that have made a big impact on the European VC ecosystem. Have you heard of all of them?

Quote of the day: ""Success is the result of perfection, hard work, learning from failure, loyalty, and persistence." - Colin Powell."

We deliver in-depth research, but your inbox may limit our message. To read the full newsletter, please access it through the Substack app here.

The fundraising environment in 2023 has been challenging, with total capital invested in European tech projected at $45 billion—a 38% decline from 2022 but still the third-highest year on record. This resilience highlights the strength of the ecosystem despite market pressures (Atomico: State of European Tech).

Despite these challenges, our members have successfully mobilized substantial capital. Here's a spotlight on some remarkable achievements.

Celebrating Fundraising Accomplishments 🌟

💡 Nordic Science Investments (NSI): New Science-Focused Fund

Nordic Science Investments (NSI) was established by tech transfer experts and experienced VC professionals to bridge a critical funding gap for seed-stage startups. In March 2024, NSI reached a major milestone with the first close of its debut fund, targeting €80 million. The fund focuses on early-stage, science-based university spinouts in the Nordics and Baltics, with 🇫🇮 Tesi among its key investors.

🔗 Related Content:

🔬 PSV Hafnium: Early bets on scientists and engineers entrepreneurs in deep tech

PSV Hafnium is a new 🇩🇰 Danish early-stage Nordic deep tech VC-fund with a first close on €55M million in 2024. The fund takes early bets on scientists, engineers, and entrepreneurs in deep tech across Denmark and the Nordics. With a comprehensive understanding of the startup journey, and roots at the Technical University of Denmark (DTU), the management team patiently helps founders scale unproven technological breakthroughs into impactful global solutions. At present PSV Hafnium has already invested in four deep tech startups.

PSV Hafnium are based at The Venture House PSV, one of their investors (formerly PreSeed Ventures), which was founded at DTU over 20 years ago and has since invested in over 450 startups.

📖 Learn More: PSV Hafnium: Deep Technology for Deep Impact

🔗 Related News: New Danish €80M early stage deep tech fund for the Nordic

🔋 Adara Ventures: Powering the Energy Transition

Adara Ventures has launched the Adara Ventures Energy Fund, its first Pan-European, thematic fund focused on technologies driving the energy transition.

Backed by leaders like the European Investment Fund (EIF), Redeia, (via its technology platform Elewit), and Grupo Energía Bogotá, this fund is set to support innovations tackling the world's energy challenges.

🚀 Its first move? Co-leading a £20 million round in SatVu, a 🇬🇧 UK-based global leader in advanced infrared imaging technology.

🌍 Learn more: Adara Ventures Energy Fund,

🚀 CC.VC: Ongoing fundraising for Fund II

Strong momentum continues during fundraising for Fund II, with over €65 million already secured, including a €35 million commitment from EIF.

🎯 MAZE Impact: New Fundraising Plans

MAZE Impact has announced plans for a smaller fund, aligning with its distinctive investment thesis focused on high-impact opportunities. Stay tuned for updates as this exciting initiative develops.

Learn more here.

🚀Exceptional Capital: $50M Fund I Success

Exceptional Capital achieved significant milestones in 2024, closing its $50M Fund I in Q1 – more than doubling its initial $20M target. The firm capitalized on strong momentum and institutional interest to surpass expectations.

Melissa Aurigemma, an European Women in VC member and part of Exceptional Capital since its inception, leads fundraising, LP relations, and portfolio support while actively participating in investment processes.

Find more about it here!

💡 European VC Trends: Fundraising Update

Since 2021, European VCs have collectively raised over $50 billion in new funds, demonstrating a continued appetite for venture investments, albeit under stricter criteria (Atomico: State of European Tech).

Moving on to: Portfolio Highlights 🚀

👉 The exit environment is showing encouraging signs of recovery. Public markets are gradually reopening, led by high-profile IPOs like Arm's $50 billion offering, which is paving the way for other tech exits. In addition, M&A activity contributed $36 billion in value during 2023, though it remains below the peaks seen in 2020 and 2021. Over the past five years, European billion-dollar exits have reached a total of 111 companies (Atomico: State of European Tech).

🏅 Kibo Ventures: Flywire Success Story

Kibo Ventures has demonstrated exceptional exit strategies, highlighted by its remarkable journey with Flywire, 🇪🇸 Spain’s first tech company to debut on Nasdaq with a $4 billion market cap.

Investment Journey: In 2013, Kibo co-led Flywire’s Series A1 with an initial €1.8M investment, which ultimately yielded €65.6M in total proceeds—marking one of the most successful exits in Spanish VC history.

Exit Timeline:

2020: Sold 1/3 of its stake at Series D valuation (pre-IPO) to Balderton and Bain Capital.

2021: Sold another 1/3 post-IPO lock-up period via a block trade at a $3.8 billion valuation.

2023: Completed its exit with open-market sales at a $4 billion valuation.

This success underscores Kibo’s ability to identify and support groundbreaking startups while achieving extraordinary outcomes on a global scale.

🔗 Learn more from Kibo’s LinkedIn post

📖 Further reading on Spain’s top VC exits

🎯 MAZE Impact: Orbital Materials

Orbital Materials, a portfolio company of MAZE Impact, secured a strategic investment from NVIDIA to advance AI-driven materials innovation and climate technologies. This partnership highlights the intersection of deep tech and sustainability.

🔗 Learn more about Orbital Materials

🌱 Revaia: Driving Climate Action

In November 2024, Revaia led a $26 million Series B for AMPECO, a leader in EV charge point management. This marks Revaia’s second climate-focused deal and the first investment from their Revaia Growth II Fund.

Focus: AMPECO empowers charge point operators with tools to optimize and scale EV networks, accelerating sustainable mobility solutions.

Revaia’s Vision: This investment underscores Revaia’s commitment to partnering with transformative businesses driving decarbonization.

🎤 XAnge: Believe Exit

XAnge celebrated the largest single-company exit in its history with Believe, a pioneer in music production and distribution.

Journey: From a seed investment in 2007, XAnge supported Believe as it grew from €2M in revenue to over €1B in 2024.

Exit: XAnge realized €150 million through this divestment, marking a key milestone for the firm.

📖 Details on XAnge’s Believe exit

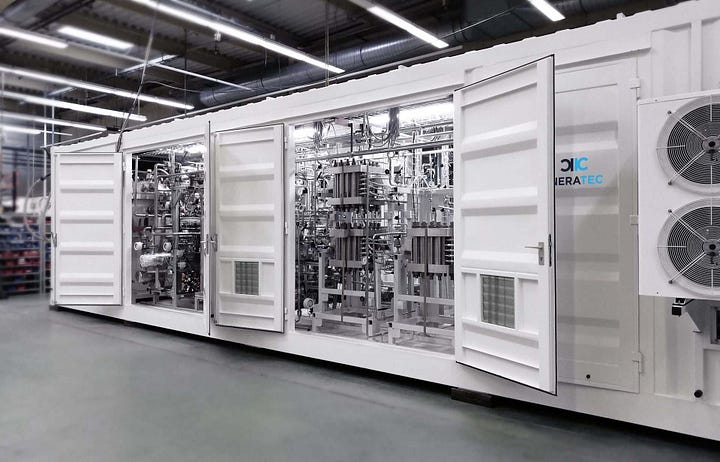

🌍 Planet A: Scaling Sustainable E-Fuels ⚡

INERATEC, a portfolio company of Planet A, raised $129 million in Series B funding to advance e-fuels for cleaner aviation and transportation solutions.

🔗 Learn more about INERATEC

📖 Featured articles on the funding round

🚀Crowberry Capital: An Exit and Two Very Relevant Achievements

The Crowberry Capital in spring went hiking in the highlands of 🇮🇸 Iceland with portfolio founders and a few investor friends - nice to see such a gender balanced group of founders.

In other exciting news:

Garden was acquired by Incredibuild, strengthening their capabilities across the DevOps lifecycle.

Aldin Dynamics went viral with their innovative approach to VR gaming.

Saidot formed impactful partnerships and garnered Financial Times attention for their focus on AI and compliance.

🔬 Onsight Ventures Celebrates First Investment Success

Onsight Ventures, 🇦🇹 Tyrol’s first venture capital fund, marks a major milestone with its investment: Black Semiconductor. The 🇩🇪 Aachen-based deep-tech startup secured a total of €254.4 million in funding:

€228.7 million in public non-repayable funding from the German Ministry of Economic Affairs and North Rhine-Westphalia under the IPCEI ME/CT2 program.

€25.7 million in equity funding from private investors.

This success highlights Onsight Ventures’ role in fostering groundbreaking technologies with global impact.

💡 European VC Trends: AI and Portfolio Monitoring in VCs

An increasing number of VCs are adopting AI and data-driven approaches for portfolio monitoring, with 60% of firms automating internal tasks. This shift enables firms to focus more on strategic activities such as founder support and portfolio growth (Atomico: State of European Tech). EWVC organised a Lunch & Learn session on the topic in spring with over 100 participants.

Wrapping Up: Relevant Updates 🎯

👉 The gender gap in VC leadership persists, with women making up only 16% of General Partners. This disparity impacts funding distribution, as female VCs are more likely to fund women-led teams—a critical step toward greater inclusivity in the ecosystem (Atomico: State of European Tech).

1. Course Corrected VC: Top Quartile Returns

Course Corrected continues to excel, achieving top quartile unrealized returns during the year, a testament to their robust investment strategy and portfolio management.

2. MAZE Impact: Celebrating 11 Years

This year marks 11 years of MAZE Impact, with the four partners celebrating a decade of driving positive change. Cheers to continued impact and success!

3. XAnge: Series A Blueprint

At Bits & Pretzels 2024, XAnge unveiled the Series A Blueprint, an essential guide designed to support seed-stage founders as they navigate the journey to Series A funding.

The playbook is packed with practical insights on leadership, performance metrics, and growth strategies.

Developed with partners like AWS, Zendesk, HV Capital, Carta, and Torq.Partners.

🔗 Discover the Series A Blueprint

… and Award for Best Operating Team

In September 2024, XAnge’s Startup Success Team received the "Best Operating Team" award from France Digitale. This accolade celebrates their solutions-focused platform, which empowers founders and C-level executives to overcome operational challenges and scale with confidence.

4. VOIMA Ventures: Diversity Drives Innovation

Voima Ventures’ Founder & Managing Partner, Inka Mero, highlighted how diversity accelerates innovation in an exclusive interview.

5. GoHub Ventures: Founders Day!

GoHub Ventures’ highlight of 2024 was Founders Day, a two-day event held on October 21st and 22nd at the picturesque Bellver Blue Tech Zone.

The event brought together portfolio founders, investors, and industry experts to discuss key topics shaping the startup ecosystem:

🔹 The future of healthcare

🔹 The geopolitics of technology

🔹 Managing burnout in founders

🔹 Fundraising trends, exits, and M&A strategies

🔹 Insights into the LatAm market

🔹 Building profitable B2B SaaS as a solo, non-technical female founder

🔹 Managing international teamsGoHub Ventures’ annual gathering fosters connections and synergies within its network, creating opportunities for growth and investment – all while embracing the Mediterranean lifestyle.

🎥 Watch the recap video here: GoHub Founders Day 2024

6. Smart Society Ventures: Smart Society Show

This year, Smart Society Ventures launched The Smart Society Show, a podcast dedicated to exploring the cutting edge of climate tech, sustainability, and innovation. Co-hosted by Brynne Kennedy, Managing Partner and co-founder of SSV, and SSV Founding Advisor, Chris Skidmore, the former 🇬🇧 UK Energy Minister who signed the UK's net-zero commitment into law, the podcast has become a platform for insightful discussions with some of the brightest minds in the field.

7. Kibo announces a new partner!

Jordi Vidal has been promoted to Partner at Kibo Ventures! Since joining in 2017, Jordi, based in 🇪🇸 Barcelona, has been a driving force behind our growth. His founder-first approach and deep venture expertise have been key to the success of the firm. We are happy to see Kibo grow!

8. Innovestor's 10th Anniversary

Over the past decade, they’ve become one of the most active VC investors in the Nordics, and expanded into real estate, corporate venturing, and energy storage. Over 230 guests - investors, partners, founders and friends - gathered at their office to mark this milestone in true Innovestor style.

💡 European VC Trends: Portfolio Evolution

While the number of new $1 billion-plus European tech companies has declined significantly—only seven new entrants in 2023 compared to over 100 in 2021 (Atomico: State of European Tech)—there are clear signs of recovery and resilience, driven by strategic exits and innovative portfolio milestones.

🙌🏼 People who inspired us lately

🔥 Molly Mielke

GP at Moth Fund, Venture Capitalist

Molly Mielke, is the sole General Partner at Moth Fund, a firm she launched with a $6 million raise. Despite no formal investment track record, Mielke secured backing from prominent limited partners including Cendana Capital, Marc Andreessen, Fred Ehrsam, and Daniel Gross. Focused on early-stage startups, Mielke writes checks up to $250,000, with investments in innovative companies like Infinite Machine, an electric scooter firm.👉 Read more here: Forbes Profile

🔥 Willemijn Verloop & Machtelt Groothuis

Founding Partners at Rubio Impact Ventures, Venture Capitalists

Willemijn Verloop and Machtelt Groothuis, 🇳🇱 Netherland-based Rubio Impact Ventures founding partners, prove that profit and purpose can coexist and thrive in venture capital. Driven by a shared belief that businesses can generate strong social impact while creating financial returns, they built a VC firm that invests in companies tackling critical climate, health, education, and food security challenges.👉 Read more here: Rubio’s story

🤑 Latest Fund News

🌿 FIGR Ventures Launches Family Office Fund

FIGR Ventures, 🇬🇧 UK-based family office fund co-founded by Fiona Humphries and Ellie Craig, has officially launched. The fund focus on investing in early-stage businesses that drive positive environmental and social change by influencing consumer behavior.

✨ Sarah Drinkwater Closes Common Magic I

Sarah Drinkwater, Solo GP of Common Magic, has announced the final close of Common Magic I, a fund dedicated to backing products with community at their core. Despite the hurdles of raising in a challenging 2023/2024 market, Sarah stayed true to her vision, prioritizing energy management and securing "true believer" LPs who share her long-term thesis. 👏🏼

Funding news 📺⚡

🚀 Pathway Raises $10M Series A

🇫🇷 French Pathway, co-founded by Zuzanna Stamirowska and Claire Nouet, has secured a $10 million Series A round led by TQ Ventures. The company’s platform leverages real-time AI data systems to deliver transformative insights, positioning itself as a leader in advanced AI solutions. 👏🏼

🧬 €11M Seed Round for AI-Powered Drug Development

Co-founders Fanny Jaulin and Diane-Laure Pagès have raised an €11 million Seed round led by Singular to launch their cutting-edge AI-powered drug development products, driving innovation in the healthcare and biotech sectors.👏🏼

🎧📚 What are we reading and listening to?

🎉 FT’s Women of 2024: Celebrating Influence and Impact

The Financial Times Weekend Magazine has unveiled its Women of 2024, a list spotlighting 25 of the world’s most influential women across politics, tech, culture, and beyond. The unranked list features change makers reshaping our world, penned by equally influential women.

📰 Explore the full list here: FT Women of 2024.

What we have been up to? 🎉

Climate Coffee ☕

Alice Tealdi joined the first edition of Climate Coffee in 🇬🇧 London! Such a buzzing atmosphere, surrounded by investors, operators, founders and many more players and discussing the innovations around the ClimateTech space! 🌍 🍃

Climate Coffee is now present in 6 cities, 3 countries, 17 local organisers, +1200 members.

🔗 Join the discussion

Beyond the Billion 💡

Exploring how family offices manage approximately 54% of global wealth and their potential to empower female founders. Alice Tealdi represented European Women in VC during this Investor Roundtable session. Joining her were:

Miruna-Ioana Girtu | Heritage Holdings, Natasha Lytton | Seedcamp, Saloni Bhojwani | Pink Salt Ventures, Stephanie Heller (Galantine) | |Bootstrap Europe, ⚡Anne Ravanona | Global Invest Her and Shelly Porges | Beyond The Billion as a moderator.

🔗 Check it out here & find more insights here

With Intelligence, Women’s Venture Capital Summit Europe

The Women's Venture Capital Summit Europe in 🇬🇧 Hertfordshire was an absolutely fantastic experience! We were proud to partner with this amazing event, which brought together 200 incredible women from the VC ecosystem.

Kasia Piasecki joined the panel discussion on "What’s Needed to Keep Women in the VC Industry?". Joining her were:

Eleanor Kaye, Newton Venture Program, Elodie Donjon, European Investment Fund (EIF), Anieke Lamers, Borski Fund, and Janneke Niessen, CapitalT

Kinga Stanislawska joined a panel discussion on "Boosting Europe’s Tech Profile: What Will It Take and What Can VCs Do?". The panel featured: Raluca Ragab, Eurazeo, Bindi Karia, Molten Ventures, Tamara Savic, Export and Investment Fund of Denmark, and moderated by Camilla Richards from Atomico.

We also co-hosted a networking breakfast with With Intelligence. Thank you to everyone who joined us!

🔗 Find all about it here & here!

Empowering Equity III ✨

Kinga has been a part of European Investment Fund (EIF)'s Empowering Equity III conference. The path is clear: mixed teams need to manage more capital. We have come a long way since the first meeting of 27 female GPs with Mariya Gabriel online, our White Paper Petition signed by 1500 investors (thank you to Laura González-Estéfani ❤️ without whom this would not have happened!). We still have much to do! Looking forward to collaborating 🇪🇺 !

🔗 Dive into the details

Forbes Women Poland 🌟

🎉 We have been celebrating the incredible nominees and winners of Woman of the Year 2024! Huge congrats to Kasia! 👏🏼

Special thanks to Forbes Women Poland for hosting such a memorable event.

We have also been discussing impact! ✨

Kasia Piasecki participated in the discussion alongside Fredrik Hånell, Impact Ventures, EIT Urban Mobility, Valtteri Vulkko, The Upright Project, and Catarina Andrez, EIT Urban Mobility as moderator. During this one-hour webinar, they shared insights and discussed the definition of positive impact and how venture capital and diversity can have a massive contribution to social and environmental impact, while at the same time give financial return.

Attend one of our partners’ events 🎟️

Techchill, February 5-7th 2025, 🇱🇹 Riga.

15% discount on tickets. Use code: EUWVCxTechChill

0100 DACH, February 18-20th 2025, 🇦🇹 Vienna.

11th edition | 400+ attendees | 300+ LPs & GPs | 100+ Speakers

0100 Europe, April 2-4th 2025, 🇳🇱 Amsterdam.

3rd edition | 700+ attendees | 500+ LPs & GPs | 140+ Speakers

0100 Emerging Europe, May 14-16th 2025, 🇭🇺 Budapest.

14th edition | 500+ attendees | 400+ LPs & GPs | 130+ Speakers

0100 Mediterranean, 🇮🇹 Milan.

As 2024 comes to a close, we thank you for your support and look forward to reconnecting in 2025! 🎉 Wishing you a joyful New Year filled with peace, happiness, and success. 💙 Take a moment to relax, celebrate, and recharge. Here’s to a fantastic year ahead!

We're a squad of over 1000 senior female venture capital wizards from all over Europe and beyond. We're here to flip the script and make things right.

Join us in shaking up the VC world! 🚀

Join us as member, partner or ally

Take care!

European Women in VC

Follow us on LinkedIn