📬 EWVC August Newsletter: What it really takes to be a value-add investor?

Welcome to our August edition, exploring the real skills and strategies that define a truly value-add investor in today's market.

Quote of the day: “Not adding value is the same as taking it away.” - Seth Godin, entrepreneur and best-selling author.

Dear Friends of European Women in VC,

Today, the European venture ecosystem is more concerned than ever on the impact of their investments. According to our recent report, Beyond Returns: Venture and Growth Investing Fuelling Sustainability and Societal Change, of the €53bn raised by European Startups in 2023, 1/3 was raised by startups addressing one or more of the UN SDGs, and 73% of LPs in venture funds say alignment with SDGs and impact is of key importance.

In an increasingly competitive market, simply providing capital is no longer enough for a venture capital firm to stand out.

According to research by Forward Partners, 92% of VCs self-describe as value-added investors, yet only 30% of founders have access to their investor’s network and support.

In fact, 42% of startup failures result from misreading market demand and another 23% from a weak founding team. The right kind of support from investors can differentiate between success and failure.

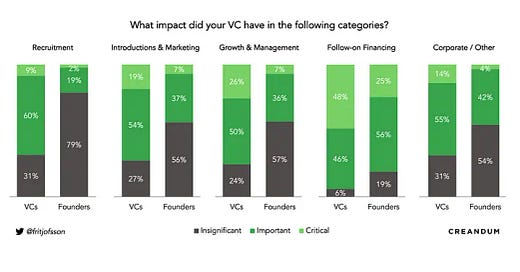

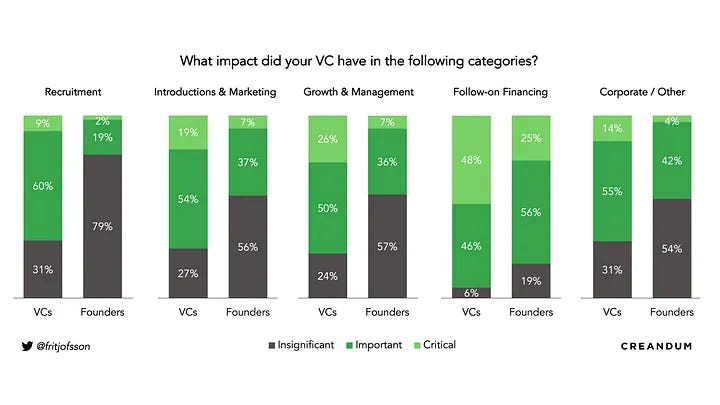

While VCs may believe they are providing substantial value, founders may feel that their support falls short of their needs or is not tailored effectively to their specific challenges, according to a survey by CREANDUM.

There is still a massive gap between how much we currently do and how much more we can do.

Adding value as an investor goes beyond just providing capital.

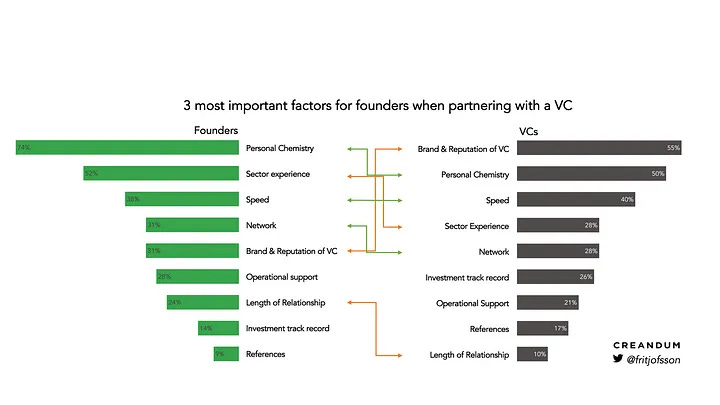

Founders and VCs prioritize different factors when evaluating potential partnerships. While VCs often emphasize their brand and reputation, founders emphasize personal chemistry and sector experience more.

Brandon Maier, Founder and GP of LvlUp Ventures, mentions that it takes effort from both sides because it requires a mutual understanding of needs for efficient collaboration. Founders are looking for partners who can accelerate their growth, offer strategic insights, open doors, and help navigate the inevitable challenges of scaling a business.

“What a lot of people don’t realise is that venture capital is one of the only asset classes where the asset chooses the investor as much as the investor chooses the asset.”

Rory Stirling • Partner, Connect Ventures • source: Forward Partners

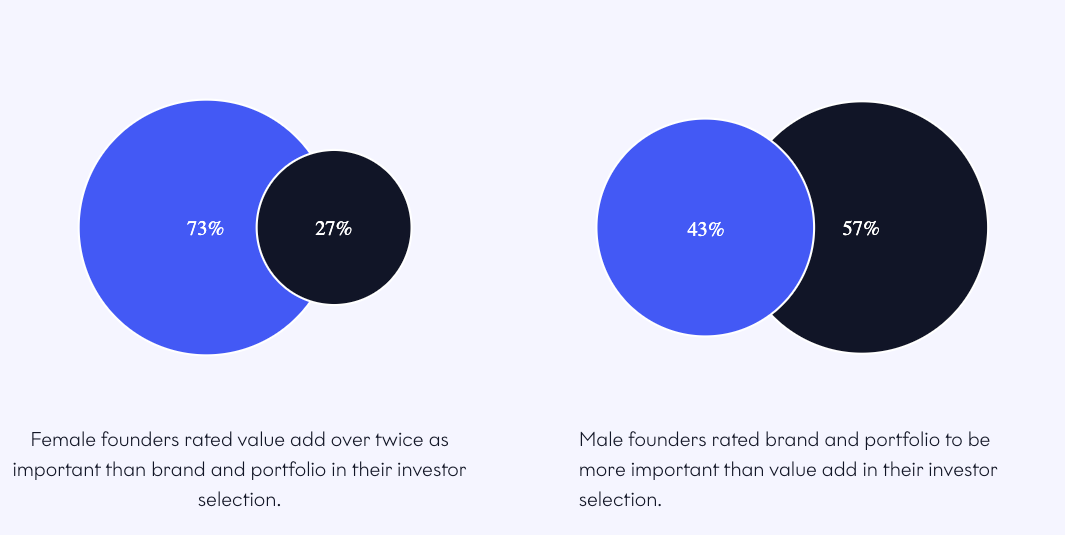

As investors, we should look at how much value we add through our investments and our day-to-day interactions. When discussing a possible investment deal, founders look for it more than it might be visible initially since choosing a fundraising partner looks personal, especially if we are talking to female founders.

A great value-added investor generates revenue for the company.

Founder’s needs are different from one company to another, and there is no one-size-fits-all recipe that we can give you. But, there is one thing that all founders need: revenue generation for their companies, which can translate in different actions such as introductions to strategic clients, opening the network, using lessons learned from pervious investments to bring in strategic and industrial expertise. Creating a VC platform as a centralized hub of resources, support, and expertise.

VC platforms actively contribute to the growth and development of their portfolio companies. Visible VC has a great guide on how to use the TOPSCAN framework to build your first platform.

Read more:

VC Platform - 2,100+ operational venture capital professionals focused on building relationships and supporting founders.

Cathay Innovation Platform example

🙌🏼 People who inspired us lately

🔥 Inés Calabuig, Almudena Trigo Lorenzo, Rocio Pillado & Sonia Fernandez

Inés Calabuig - Managing Partner at GoHub Ventures, Almudena Trigo Lorenzo -Founding Partner & Chairwoman at BeAble Capital, and Sonia Fernandez - Partner at Kibo Ventures and Rocio Pillado - Partner at Adara VC have been included in a list of Leading Female VC Partners in Spain in 2024, by Startup Researcher - Europe. Check out their profiles and the list of all the inspiring ladies driving change in the Spanish startup ecosystem below.

Discover the list here.

🔥 Helen Agering

Helen Agering, Partner at Spintop Ventures has been nominated as a finalist in the Nordic Women in Tech Awards in the category investor of the year.

Helen had +600 nominations across the Nordic countries, being recognised for her contributions to inspire more women to choose a career path in tech, and as an inspiration role model in the tech and venture industry.

Read more about the news here.

🔥 Jacqueline van den Ende

Jacqueline van den Ende, co-founder and the CEO of Carbon Equity, has been nominated as the Emerging Entrepreneur of the Year award by EY.

Read more about the news here.

🔥 Molly Alter

Molly Alter, a filmmaker joins Northzone as Partner. Molly’s unconventional path to venture capital began with her creative upbringing in theater and improv, which led to founding a company at Harvard that filmed a cappella concerts and dance recitals.

Read more about the news here.

🔥Anne-Sophie Krechting and Carolina Decastri

Anne-Sophie Krechting (VC Investor) and Carolina Decastri (Platform Engagement Lead) at Atlantic Labs mentioned in the top 100 women in VC and startups in Germany by Vestbee.

Read more about the news here.

🔥 Miriam Rivera

Miriam Rivera, co-founder and Managing Director of Ulu Ventures inspired us all with her story. Going from a child speaking no English at school, to later being told the VC space is “a young man’s game”, to becoming a success story from Silicon Valley.

Read more about the news here.

🤑 Funding News

Female Invest closes $11.2M Series A

Camilla Cloëtta Falkenberg, Emma Due Bitz, and Anna-Sophie Hartvigsen of Female Invest closed a $11.2 million Series A round, breaking four world records in the process.

The funding round, led by Educapital and Rubio Impact Ventures, will boost their mission to close the financial gender gap. Since 2020, they’ve grown 12x, with over 73,000 members across 123 countries. They raised $1M out of the $11.2M through crowdfunding in just four minutes, making history.

Read more about the news here.

The Auxxo Female Catalyst Fund

🇩🇪 The Auxxo Female Catalyst Fund performed a pre-closing of its second fund in mid-July.

A day later, they invested in their first portfolio company (which has not yet been disclosed). The €50M (target size) Auxxo Female Catalyst Fund II has a commitment by the EIF as an anchor and will co-invest in the strongest female-co-founded startups in Pre-Seed and Seed stages across Europe.

Carbon Equity announces the closing of Fund III at €60M

🇳🇱 Amsterdam-based, Carbon Equity has achieved a strong close of their Fund III, raising €60M from 160 investors in under four months. This brings them to over €250M capital raised for investing in climate solutions until now.

The Climate Tech Portfolio Fund III will invest in 7-10 of the world's most exciting climate technology venture capital and private equity funds across Europe and the US.

Read more about the news here.

What we are reading 🤓 and listening 🎧 to:

Underdog founders are the ones building unicorns

While unicorns were once predominantly led by male founders, this is changing, with 17% now having a female founder as of 2023. Education plays a significant role, with over half of unicorn founders holding degrees from top global universities and nearly half of CEOs having STEM degrees—a figure even higher among female founding CEOs.

The Unicorn Founder DNA Report by Defiance Capital analysed 845 unicorns and 2,018 unicorn founders set out to look at the “DNA” of unicorn founders, to define the common traits of these kinds of founders.

Read the article here.

Flo Health becomes the first European femtech unicorn

Flo Health, a women's health app, has secured $200 million from General Atlantic, becoming the first fully digital women's health app to surpass a $1B valuation.

Flo Health’s latest fund raise has been thought provoking - a startup founded and funded by men became the first European unicorn in WOMEN'S health.

68% of the 5,400 women want to learn AI

Women Go Tech published a new study on women and AI in the CEE region. The study, "Women and AI: challenges, perceptions, and perspectives," surveyed over 5,400 women across 13 European countries. The research aims to address gender equality in tech and provides valuable insights into the challenges and perceptions women face in AI fields.

Read the report here.

26 women to watch in CVC Northern Europe

Global Corporate Venturing has recently published a list of 26 women to watch in the corporate venture capital space, in northern Europe, following a two-years project.

Read more about the news here.

From Lawyer to Tech Founder of App with 3 million+ users

The latest episode of The Startup Leap podcast features Yvonne Bajela and Maria Rotilu in a conversation with Michelle Kennedy, founder of Peanut.

Michelle shares invaluable insights on building a successful platform by women, for women, from her impressive transition from lawyer to tech leader, to her behind-the-scenes experiences at Badoo and Bumble.

Listen the podcast episode here.

You might also like 📚👀

Energy transition at risk: The imperative to innovate in mining

As we shift from fossil fuels to clean energy technologies, the demand for critical minerals like lithium, copper, and cobalt is skyrocketing. However, the supply of these essential resources is increasingly strained due to limited reserves, geopolitical risks, and the environmental impact of mining.

Nucleus Capital published a great analysis on this topic recently that we recommend you to explore.

Read the article here.

Deep Dive: VC Value Add

There’s a significant disconnect between how VCs perceive the value they provide and how founders actually experience it, with 61% of founders rating their value-add experience as below average.

Read the article here.

The need for value-add investors in the early stages

Value-add investors play a role in helping companies navigate challenges, scale effectively, and achieve long-term success. In a competitive venture landscape, being a value-add investor is seen as essential for creating meaningful impact and differentiating yourself.

Read the article here.

Bridging the gap: The rise of the Solo GP

Beata Klein from Creandum opened a discussion about Solo GPs. Those who operate independently, are highly important players in the European venture ecosystem addressing the decline in pre-seed funding. They offer a unique blend of agility, sector expertise, and personalized support, making them invaluable to early-stage startups.

Read the article here.

Meet our team 🧳 at:

Baltic VCA Summit, September 5-6th, 🇱🇹 Vilnius

15% discount on tickets. Use code: LTVCA_Group

Investing in Positive Outcomes VC/PE and LP breakfast, September 5, 🇱🇹 Vilnius

TechBBQ, September 10-12th, 🇩🇰 Copenhagen

Nordic Investor day, September 10th, 🇩🇰 Copenhagen

Corporate Venture Summit, September 10th, 🇩🇰 Copenhagen

Women VC & Angel Investor Meet-up at Tech BBQ, September 11th, 🇩🇰 Copenhagen

LP/GP Breakfast at TechBBQ, September 11th, 🇩🇰 Copenhagen

Climate LP Breakfast, September 20th, 🇩🇪 Berlin.

Pitch HearstLab London, October 16th, 🇬🇧 London

SLUSH, November 19-21th, 🇫🇮 Helsinki

LP/GP Breakfast at SLUSH, November 20th, 🇫🇮 Helsinki

Attend one of our partners’ events 🎟️:

With Intelligence - Women's Private Equity Summit Europe, September 25-27th, 🇬🇧 Windsor.

20% discount on tickets Use code: EWVC20

Valencia Digital Summit (VDS), October 23-24th, 🇪🇸 Valencia.

We have a few free tickets available, please contact us at info@europeanwomenvc.org to get one.

0100 Conference Mediterranean 2024, October 28-30th, 🇮🇹 Milan.

20% discount on tickets. Use code: EWVC20

Fe:male Invest Summit 2024, November 6, 🇸🇪 Malmö.

10% discount on tickets. Use code: NFISxEUVC24

With Intelligence - Women's Venture Capital Summit, December 2nd-4th, 🇬🇧 Hertfordshire.

20% discount on tickets. Use code: EWVC20.

🌱 "Lunch & Learn" on BEYOND RETURNS: Report 2024

We’re thrilled to invite you to our upcoming European Women in VC Lunch & Learn session, where we bring together industry leaders for an inspiring and insightful discussion.

This time, we're honored to have Carolyn Dawson from Founders Forum, Emma Wheeler from UBS, and Kevin Rodrigues from bp ventures join us. Our host, Kinga Stanislawska, will lead the conversation as we dive into the key findings from our latest report, "BEYOND RETURNS: Venture and Growth Investing Fuelling Sustainability & Societal Change."

⏰ Sept. 6 | 13:00 CEST | 📍Online

We're a squad of over 1000 senior female venture capital wizards from all over Europe and beyond. We're here to flip the script and make things right.

Join us in shaking up the VC world! 🚀

See you soon,

European Women in VC

Follow us on LinkedIn